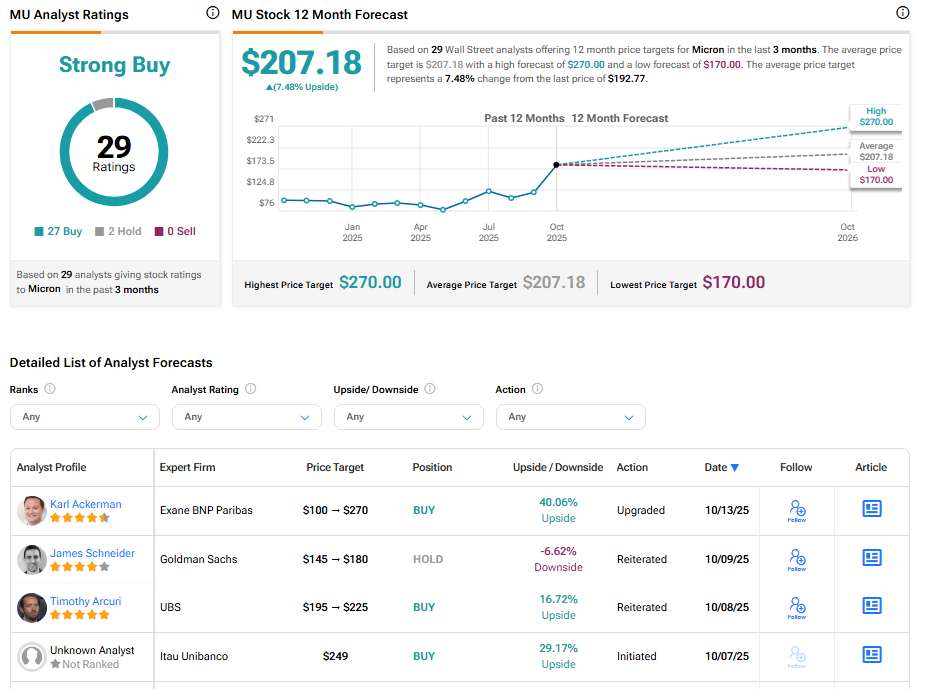

Micron (MU) jumped over 6% on Monday after top BNP Paribas Exane analyst Karl Ackerman made a double upgrade, raising the stock to Outperform from Underperform and setting a Street-high price target of $270, up from $100. The revised price target reflects an impressive 40% upside potential from current levels. The analyst now sees a powerful recovery ahead for the memory chipmaker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The upgrade is notable, as Ackerman had one of the lowest price targets on Micron just months ago. Now, his $270 call stands as the highest on Wall Street. He said the change reflects better clarity on HBM demand and a faster recovery in memory pricing.

Analyst Turns Bullish on Memory Market

Ackerman said he now sees high-bandwidth memory (HBM) as a steady new growth driver for Micron. He believes the company is in a good position to gain from rising AI demand and expects HBM to become a key source of profit in the coming years. The analyst called this the early phase of a “memory supercycle,” pointing to a new growth wave across the memory market.

He said the rise of AI technology is changing the memory market and creating steady demand for faster, more efficient chips. Ackerman noted that Micron’s advances in HBM give it an edge over competitors and could help lift its profits through the rest of the decade.

Adding to the bullish tone, Evercore ISI analysts also lifted their price target on Micron to $137 from $100, citing similar optimism about its AI-driven momentum.

Is Micron a Good Stock to Buy?

Micron stock has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 27 Buy and two Hold recommendations assigned in the last three months. The average MU price target of $207.18 implies 7.48% upside from current levels.