There was good news for Micron Technology (NASDAQ:MU) in Thursday’s trading session as Citi started up a “90-day catalyst watch,” looking for Micron to break out to the upside. Nevertheless, shares are down fractionally at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Citi had some points that should have been much more encouraging to investors. Citi’s catalyst watch was based around “…a higher multiple given our expectation that DRAM pricing will inflect this quarter.” That’s the word from Citi’s analyst Christopher Danely. He also noted that Micron is Citi’s top pick in the entire semiconductor sector, making it a leading chip stock.

One of the biggest things likely to help Micron going forward is recent hikes in the price of memory. It hiked its prices on NAND flash wafer contracts by around 10%, a move which allowed it to keep rough parity with Samsung (OTHEROTC:SSMMF). However, there’s a downside to this move as well.

The price hike on NAND was a move to keep parity in the rest of the market. That’s not a sign that buyers are coming back to the table. Indeed, Micron has been writing down the value of its inventory for most of the last year. Just in the nine months ending June 1, Micron wrote down $1.8 billion worth of inventory. Throw in a declining macroeconomic picture and that isn’t encouraging news.

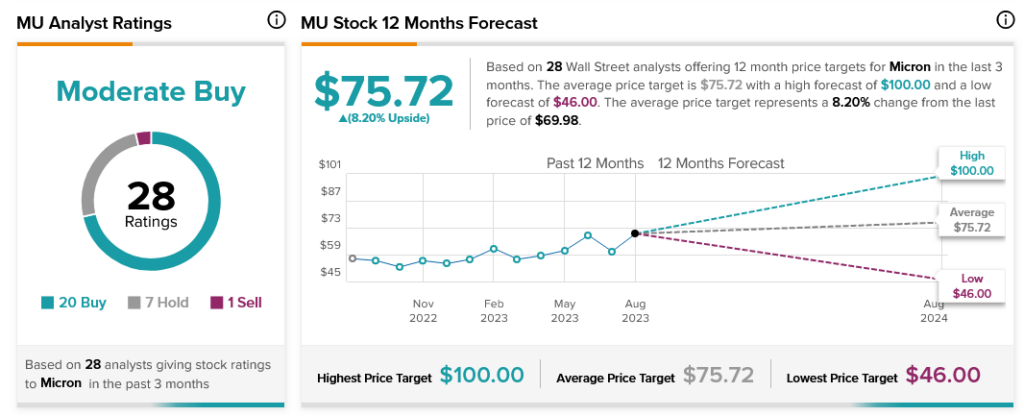

Still, analysts are mostly on board. With 20 Buy ratings, seven Holds, and one Sell, Micron stock is considered a Moderate Buy by analyst consensus. Meanwhile, its average price target of $75.72 gives Micron stock 8.2% upside potential.