Micron (MU) stock fell on Tuesday after the semiconductor company was hit with a downgrade from five-star Street analyst Pierre Ferragu. The analyst dropped MU stock to a Hold rating from a Buy rating and set a $190 price target, suggesting a possible 0.08% upside for the company’s shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ferragu’s decision to downgrade Micron comes despite increasing demand for high-bandwidth memory. While the analyst acknowledged this, he said that MU stock trades at “peak multiples.” He also noted expectations for the company’s earnings beats to be offset by continued multiple compression.

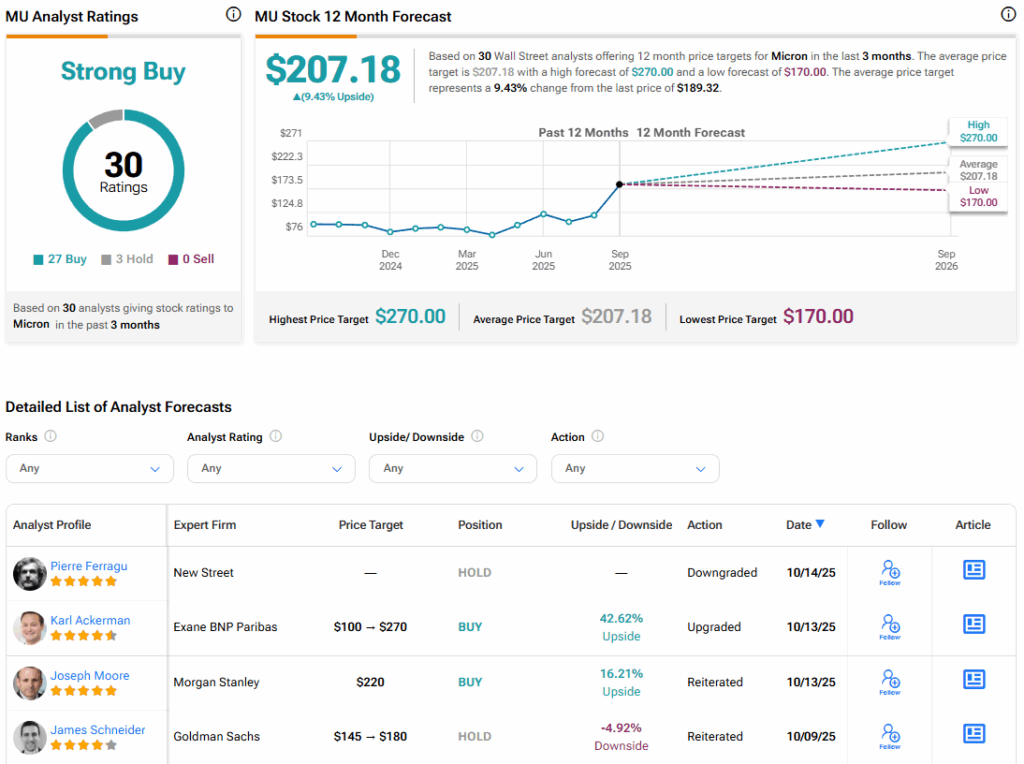

Ferragu isn’t the only analyst to weigh in on Micron stock recently. Exane BNP Paribas analyst Karl Ackerman upgraded the stock to a Buy rating with a $270 price target yesterday, implying a 42.22% upside. At the same time, top Morgan Stanley analyst Joseph Moore reiterated a Buy rating with a $220 price target, representing a 15.88% upside for the shares.

Micron Stock Movement Today

Micron stock was down 1.65% on Tuesday but was still up 129.71% year-to-date. The shares have also rallied 84.79% over the past 12 months. Micron is among the tech companies that have benefited from the AI boom and the increased demand for its products. This is due to an increased number of data centers being built to power AI technology. With plans for more data centers, Micron is likely to have a wealth of customers in need of its offerings.

Is Micron Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Micron is Strong Buy, based on 27 Buy and three Hold ratings over the past three months. With that comes an average MU stock price target of $207.18, representing a potential 9.43% upside for the shares.