New York’s Public Service Commission has approved a new underground transmission line that will connect an existing Clay substation to Micron Technology’s (MU) future semiconductor megafab in Onondaga County, Governor Kathy Hochul announced on Thursday. It’s important to note that the two-mile, 345-kilovolt line is considered a critical infrastructure project that will support the chipmaker’s planned $100 billion investment in Central New York, which is the largest private investment in the state’s history.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unsurprisingly, the megafab is expected to significantly boost the region’s economy, as more than 50,000 jobs are expected to be created over the next 20 years, including 9,000 direct roles at Micron. As a result, Governor Hochul called the project transformative for Central New York and emphasized that the state is committed to moving the development forward without delay.

In addition to the transmission line, the Public Service Commission also approved environmental and construction plans tied to the first phase of the project. This includes expanding the eastern portion of the Clay substation and installing the necessary equipment to connect it to the upcoming Micron facility. Once operational, the megafab will have the goal of producing 25% of all U.S.-made semiconductors by 2030.

Is MU Stock a Good Buy?

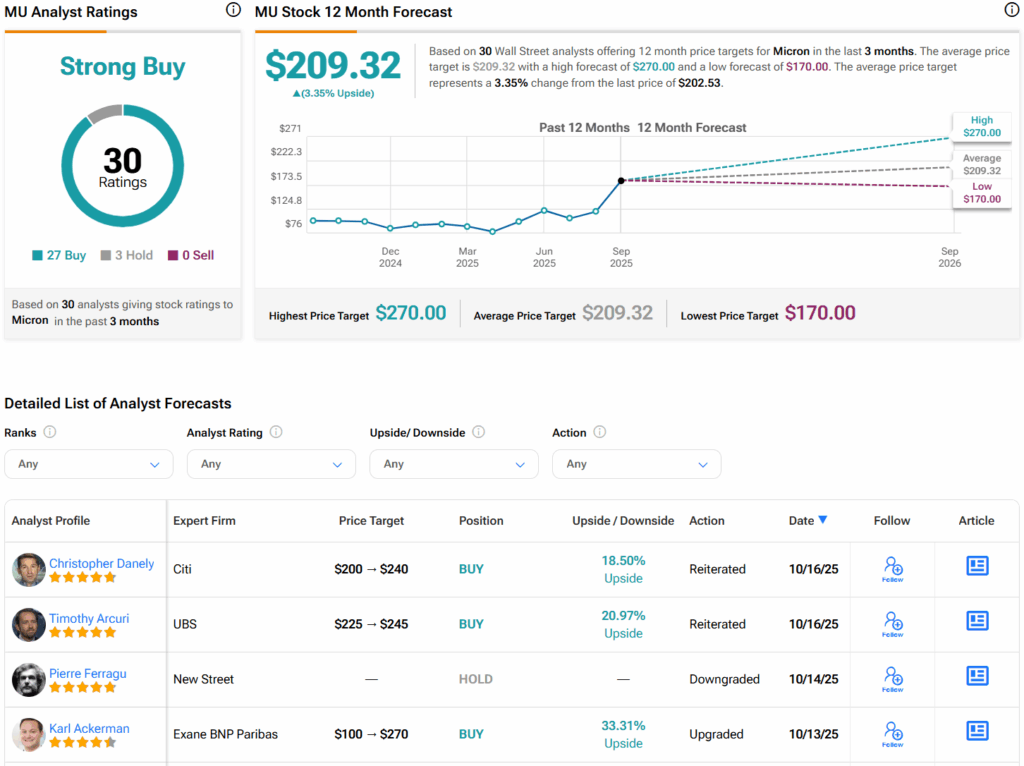

Turning to Wall Street, analysts have a Strong Buy consensus rating on MU stock based on 27 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average MU price target of $209.32 per share implies 3.4% upside potential.