Casino, hotel, and entertainment resort operator MGM Resorts International (MGM) is continuing its push into digital gaming with the acquisition of LeoVegas. The latter is an online gaming company with licenses in the Nordics and the rest of Europe. The Stockholm headquartered company garnered EUR 393 million in revenue during the year ended March 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company has begun a public tender offer to acquire all the shares of LeoVegas at SEK61 per share in cash. This equates to a total tender value of about $607 million. The transaction is anticipated to be accretive to MGM’s earnings and cash flow per share.

Management Weighs In

Bill Hornbuckle, CEO & President of MGM Resorts commented, “Our vision is to be the world’s premier gaming entertainment company, and this strategic opportunity with LeoVegas will allow us to continue to grow our reach throughout the world…We have achieved remarkable success with BetMGM in the U.S., and with the acquisition of LeoVegas in Europe we will expand our online gaming presence globally.”

MGM expects this strategic move to enable it to set up a scaled global online gaming operation that will help it expand across the globe, provide advanced product offerings, and maintain strong profitability.

The acceptance period for this offer is anticipated to begin around June 2022 and expire around August 2022. Subject to approvals and conditions, the transaction is expected to close in H2 2022.

Additionally, MGM is also forecast to announce first-quarter numbers after market hours today. Analysts expect the company to report a net loss per share of $0.05 on revenues of $2.97 billion.

Analysts’ Take

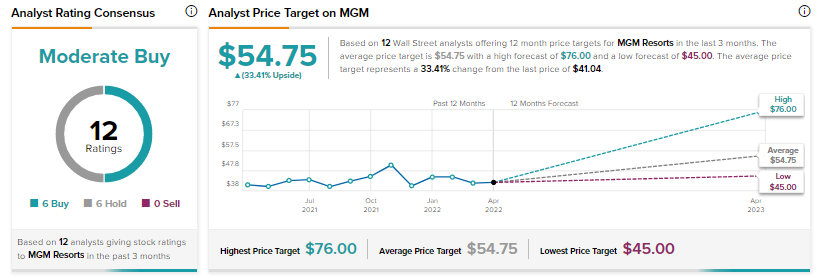

Morgan Stanley analyst Thomas Allen has reiterated a Hold rating on the stock but decreased the price target to $51 from $56.

Overall, the Street has a Moderate Buy consensus rating on the stock based on six Buys and six Holds. The average MGM Resorts price target of $54.75 implies upside potential of 33.4%. That’s after a nearly 10% slide in the share price so far this year.

Hedge Fund Activity

Hedge funds’ confidence in MGM remains negative based on the activities of 11 hedge funds in the recent quarter, which decreased their holdings in the stock by 175,400 shares.

Closing Note

This strategic move is expected to enable the company to build on its gains in digital gaming in the U.S. Moreover, LeoVegas’ global footprint and technological expertise could drive MGM’s digital gaming as well as sports betting verticals internationally.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Unilever Scathed as Inflation Hits Consumer Goods Sector

Moderna Seeks EUA to Vaccinate Young Children with mRNA-1273

Qualcomm Stock Rises on Upbeat Q2 Results, Strong Outlook