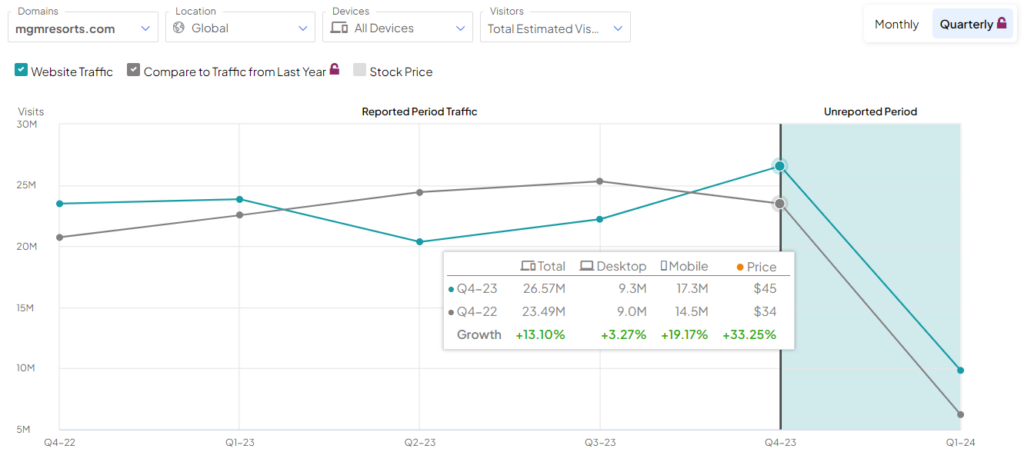

The upbeat performance of MGM Resorts (NYSE:MGM) in the fourth quarter should be of little surprise to TipRanks Website Traffic Tool users. The tool provides data about the performance of a company’s website domain, thereby offering insights into the demand for its products. This information can be used by investors to gain an idea about the company’s upcoming earnings report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MGM Resorts is a global hospitality and entertainment company renowned for its resorts, casinos, and entertainment offerings.

Here’s What Website Traffic Indicated

Ahead of the Q4 earnings release, the tool showed that website traffic for mgmresorts.com witnessed a 13.1% surge in total estimated visits when compared to the year-ago quarter and 19.6% sequentially.

Interestingly, MGM reported revenues of $4.38 billion, up 22% year-over-year and above the consensus of $4.14 billion. The company’s top-line growth was primarily attributable to higher income from MGM China, following the relaxation of COVID-19 regulations in Macau.

At the same time, the company’s adjusted earnings of $1.06 per share significantly surpassed analysts’ estimates of $0.71 per share. In the prior-year quarter, MGM reported an adjusted loss of $1.54 per share.

What Are Analysts Saying About MGM?

Following the Q4 results release, two analysts rated MGM stock a Buy. Among these, Deutsche Bank analyst Carlo Santarelli is optimistic about the company’s market share gains and expects the positive momentum in Las Vegas and Macau to continue. Additionally, Santarelli finds the stock’s valuation to be attractive.

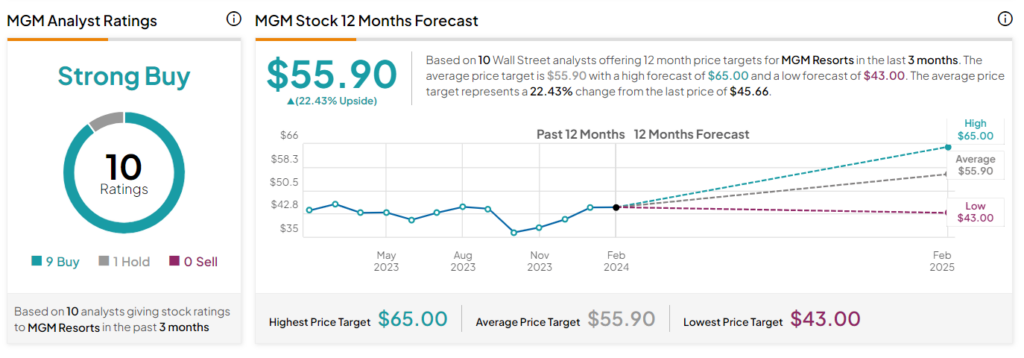

Is MGM a Buy, Sell, or Hold?

The company’s Las Vegas and Macau businesses are expected to have benefitted from higher footfall during the Super Bowl game weekend and Chinese New Year, respectively. Also, MGM’s expansion efforts in New York could support its growth going forward.

MGM stock has a Strong Buy consensus rating on TipRanks. This is based on nine Buy and one Hold recommendations. The average price target of $55.90 implies 22.43% upside potential from current levels. Shares of the company are up 13.4% over the past three months.