MGM Resorts (NYSE:MGM) reported a robust first quarter due to the inclusion of results of The Cosmopolitan of Las Vegas. The resort casino and hotel was acquired in May 2022. Also, higher business volume and strong travel demand aided results in the quarter. MGM is a global hospitality and entertainment company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported adjusted earnings of $0.44 per share, which came above the Street’s estimate of $0.06 per share. Also, the bottom-line performance increased substantially from $0.01 in the year-ago quarter.

Meanwhile, revenues came in at $3.9 billion, up 36% year-over-year, and also surpassed the analysts’ estimates of $3.6 billion. MGM benefitted from higher revenues in all its segments.

It is worth highlighting that MGM’s casino revenues jumped 32.5% to $1.88 billion in the reported quarter, particularly at MGM China and Las Vegas Strip Resorts. The prior year’s results were impacted by restrictions related to the COVID-19 omicron variant.

Following MGM’s Q1 release, JMP Securities analyst Jordan Bender reiterated a Buy rating on the stock with a price target of $60. Bender is of the opinion that MGM will continue to strengthen its business through several investments. Further, he expects operational improvements to have a positive impact on its future performance.

Recent Development

Prior to the earnings release, MGM revealed it had reached an agreement to buy the majority of game developer Push Gaming Holding. The deal, subject to regulatory approvals, is expected to close in the third quarter of 2023.

President of MGM Resorts International Interactive, Gary Fritz, said, “The acquisition of Push Gaming by LeoVegas is consistent with our vision to expand MGM Resorts’ digital gaming presence internationally to grow our capabilities and products over the next several years.”

Is MGM a Buy, Sell, or Hold?

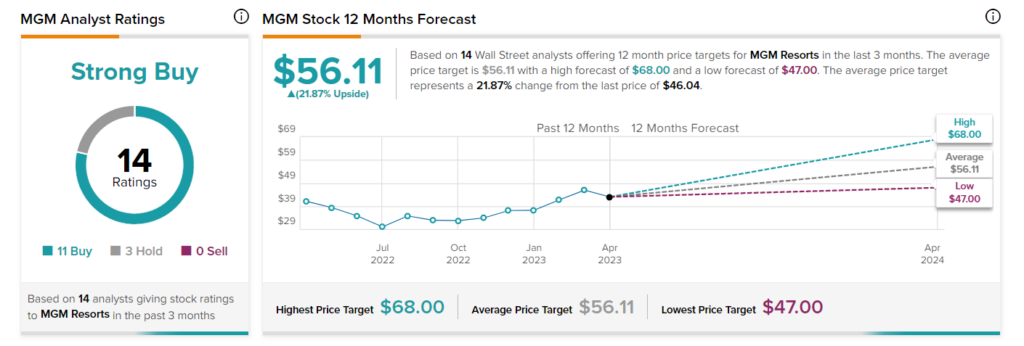

The Wall Street community is optimistic about MGM stock. It has a Strong Buy consensus rating based on 11 Buy and three Hold recommendations. The stock average price target of $56.11 implies 21.9% upside potential. Shares have gained 38.3% so far in 2023.