The mega-cap tech stocks, Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOGL), Tesla (TSLA), and Nvidia (NVDA), also called the Magnificent Seven, have delivered strong gains recently. Investors seeking exposure to these high-performing companies can consider exchange-traded funds (ETFs) as an alternative to picking individual stocks. MGK and XLG are two such ETFs with large exposure to the above seven stocks, with analysts expecting a potential upside of over 15% in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at what Wall Street analysts think about these two ETFs.

Vanguard Mega Cap Growth ETF (MGK)

The MGK ETF seeks to track the performance of the CRSP U.S. Mega Cap Growth Index. It has $18.3 billion in assets under management (AUM), with the seven tech giants constituting about 60% of its portfolio.

Interestingly, the ETF has a very low expense ratio of 0.07%. Moreover, the MGK ETF has generated a return of 18.4% over the past six months.

On TipRanks, MGK has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 81 stocks held, 71 have Buy, and 10 have Hold ratings. The analysts’ average price target on the MGK ETF of $321.76 implies a 20.13% upside potential from the current levels.

Invesco S&P 500 Top 50 ETF (XLG)

The XLG ETF tracks the S&P 500 Top 50 ETF Index, which measures the cap-weighted performance of 50 of the largest companies on the S&P 500 Index (SPX). XLG has $4 billion in AUM, with the Magnificent Seven stocks contributing about 50% of the portfolio.

It should be noted that XLG ETF has a low expense ratio of 0.2%. The ETF has returned over 18% in the past six months.

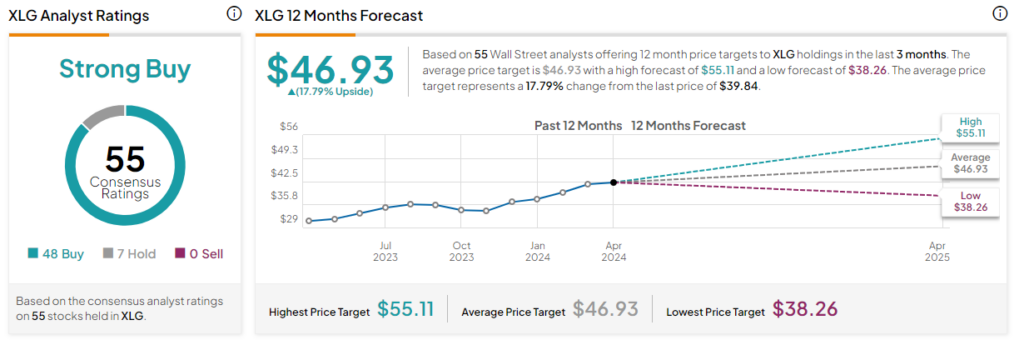

Overall, the ETF has a Strong Buy consensus rating. Of the 55 stocks held, 48 have Buy and seven have Hold ratings. The analysts’ average price target on the XLG ETF of $46.93 implies a 17.79% upside potential from the current levels.

Concluding Thoughts

Investors can capture the growth potential of the tech sector by considering investing in MGK and XLG ETFs. Both of these ETFs are cost-effective and have better liquidity, enabling investors to buy and sell shares conveniently.