Shares of precision instruments and services provider Mettler-Toledo International, Inc. (MTD) have climbed 24.1% over the past 12 months. MTD’s recent fourth-quarter performance came in ahead of expectations on both its top-line and bottom-line fronts.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Revenue jumped 10.6% year-over-year to $1.04 billion, beating estimates by $15.3 million. Earnings per share at $10.53, outperformed consensus by $0.42. This growth was driven by robust growth across the Americas and Asia/Rest of World geographies, and the company’s Laboratory and industrial product lines.

Further, amid the impact of COVID-19 and global supply chain challenges, MTD anticipates local currency sales growth of 7% in 2022 and earnings per share to be in the range of $38.15 and $38.50.

With these developments in mind, let’s have a look at the changes in MTD’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Mettler-Toledo’s top risk category is Finance & Corporate, contributing 8 of the total 30 risks identified for the stock.

However, in its recent report, the company has changed one key risk factor under the Macro & Political risk category. Compared to a sector average of 3 Macro & Political risk factors, MTD has 6.

MTD highlighted the risks and uncertainties stemming from the COVID-19 pandemic. The company’s global operations expose it to risks related to public health crisis. COVID-19 has had an adverse impact on MTD and this may continue in the future. MTD may experience volatility in its results and lower sales volumes due to decreased customer demand.

Additionally, the pandemic has also affected MTD’s workforce, and supply chain, while also making it more challenging and expensive to satisfy customer obligations. These factors and uncertainties could have a negative impact on the company’s global business, operations, and financials.

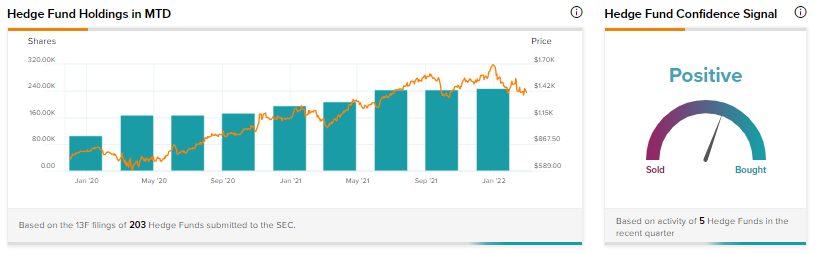

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have increased holdings in Mettler-Toledo by 2.6 thousand shares in the last quarter, indicating a positive hedge fund confidence signal in the stock based on activities of 5 hedge funds. Notably, Richard Chilton’s Chilton Investment Co has a holding worth ~$208.2 million in MTD.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

SNC-Lavalin Enters Strategic Partnership with MBC Group

ATS Automation Buys VASPAC’s IP Assets

Air Canada Reduces Loss to C$503M in Q4