Meta (NASDAQ:META) has just introduced new features within WhatsApp for users in India, its largest market. The first is a new in-chat payment feature in its WhatsApp Business Platform app. This feature enables businesses to receive payments directly within chat conversations without incurring additional fees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is providing users with three payment options, including credit and debit cards, WhatsApp Pay, and India’s public digital payments network, UPI. To facilitate these payments, Meta has partnered with PayU and Razorpay.

It is worth mentioning that Meta previously introduced the in-chat payment feature in Singapore and Brazil earlier this year.

A key reason for Meta to roll out this feature is to attract more businesses to its platform, as businesses are required to pay to message their customers (with a few exceptions to this rule). Given that India is one of Meta’s largest markets due to its substantial population, this move is anticipated to contribute to the company’s revenue growth.

In addition to the payments, Meta is offering Meta Verified to businesses using WhatsApp, Instagram, and Facebook. Subscribing businesses will receive a verified badge, protection against impersonation, and extra features to enhance their discoverability. For WhatsApp, these features encompass premium offerings, such as a customized web page and enhanced multi-device support.

Is META a Good Stock to Buy?

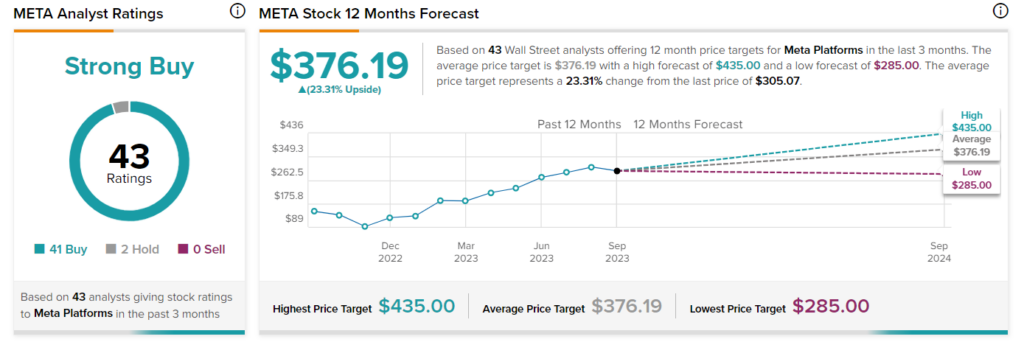

Due to Meta’s strong financial performance and healthy business outlook, analysts are optimistic about the stock. META stock has a Strong Buy consensus rating on TipRanks based on 41 Buys and two Hold recommendations assigned in the past three months. The average META stock price target of $376.19 implies 23.31% upside potential. The stock has gained about 115% so far in 2023.