Meta’s (META) artificial intelligence system, Llama, is the latest toolkit from a U.S. tech giant to be approved by the American government for use by its agencies. The update comes several weeks after Google’s (GOOGL) Gemini, OpenAI’s ChatGPT, and Anthropic’s Claude were also sanctioned for use in government operations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Llama’s adoption is to be backed by assurance from the General Services Administration (GSA) that the large language model (LLM) meets the government’s security and legal standards, Reuters reported. GSA is the procurement arm of the U.S. government.

GSA’s procurement lead, Josh Greunbaum, said government agencies will adopt the tool for uses such as faster contract review or addressing technical issues, among others. Large Language Models (LLMs) are AI systems trained on massive data to understand and respond to human language with fluency. They can answer questions, write content, generate photos and videos, among other tasks.

Microsoft and Amazon Offer Discounted Deals

Meanwhile, the approval follows recent cloud services the procurement arm secured for the U.S. government from rival tech giants such as Microsoft (MSFT) and Amazon (AMZN). GSA has said the services were provided at a steep discount.

These discounted deals aim to cut government expenses, with the Microsoft arrangement potentially saving up to $3 billion in its first year. Meanwhile, the deal with Amazon Web Services is projected to reduce cloud and IT system adoption costs by as much as $1 billion by 2028.

Big Tech Faces Lawsuits

Meanwhile, these developments come as Big Tech companies continue to compete to scale innovation in artificial intelligence and LLMs. However, lawsuits against these companies alleging copyright infringement have been piling up.

These legal cases argue that large language models (LLMs) are trained on copyrighted content without due permission or compensation. The publishers are demanding appropriate compensation for their work.

Is META Stock a Good Buy Now?

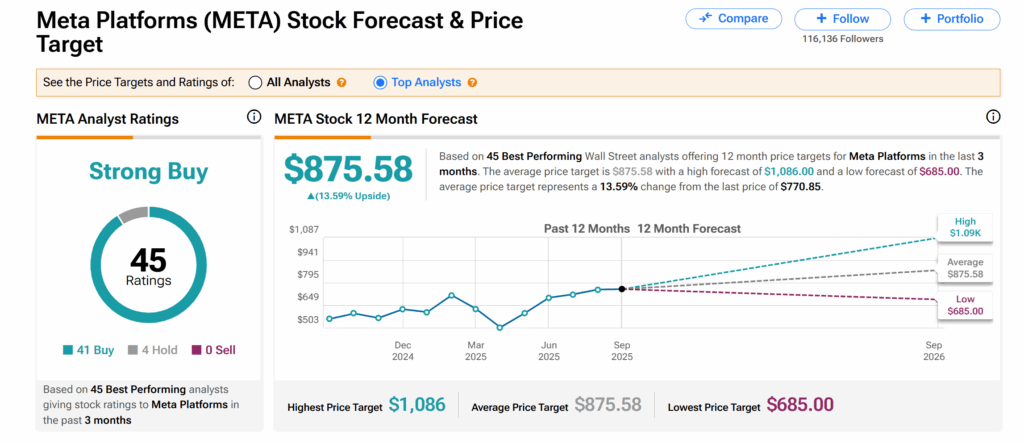

Turning to Wall Street, Meta’s shares currently boast a Strong Buy consensus recommendation on TipRanks. This is based on 41 Buys and four Holds assigned by 45 Wall Street analysts over the past three months.

Moreover, at $875.58, the average META price target indicates a 14% upswing potential from current levels.