The usage of Meta Platforms (NASDAQ:META)-owned Facebook remains unaffected even after the company imposed a ban on news availability within its platform in Canada. Meanwhile, the company said it successfully removed the Spamouflage community related to Chinese law enforcement from its platform.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s delve deeper.

Canadians Continue to Use Facebook

On August 1, Meta announced that Canadians would no longer be able to view or share news content on Facebook and Instagram, which included news articles and audio-visual content posted by local news outlets. The move was to comply with the Online News Act.

The legislation required Meta to pay local news outlets for their posted news on its platform.

In its defense, Meta stated that the news outlets voluntarily share their content on its platforms, thereby expanding their reach to a broader audience.

While Meta blocked news on Facebook and Instagram in Canada, Similarweb (NYSE:SMWB), a digital data and analytics company, said that the daily active users and time spent on Facebook remain unchanged. Like Similarweb, another analytics firm, Data.ai, noted that the Facebook platform showed no meaningful change in usage in August in Canada, Reuters reported.

Meta Uncovers the Chinese Online Influence Network

As Meta successfully drives engagement on its platform, it regularly evaluates its Family metrics to check the number of accounts violating its terms of service, including bots and spam. Further, the company disables these violating user accounts from time to time.

In a recent development, Meta announced that it uncovered a Chinese online influence network leveraging social media platforms to boost China’s image and target U.S. and Western foreign policies.

Meta removed almost 7,700 accounts from Facebook and Instagram related to the Chinese online influence network and said the network failed to get any substantial engagement.

According to a Wall Street Journal report, the Chinese government has broadly denied its role in such campaigns. However, Meta’s Global Threat Intelligence Lead, Ben Nimmo, said that the company was able to link this “Spamouflage” to individuals associated with Chinese law enforcement.

As Meta fights the Chinese online influence network, let’s look at what the Street recommends for its stock.

Will Meta Stock Go Back Up?

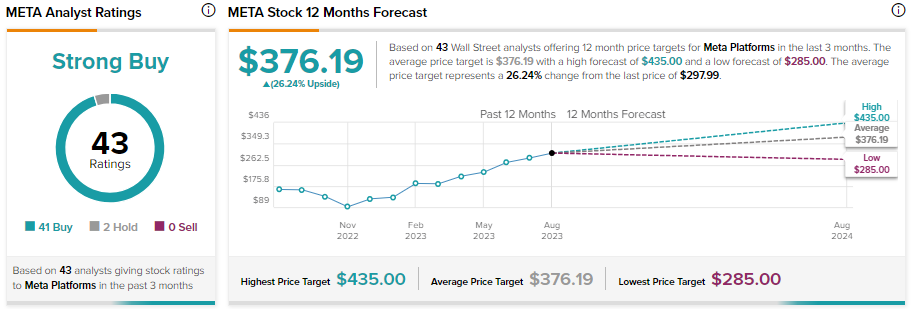

After a blistering rally in the first seven months of 2023, Meta stock cooled a bit in August. Nonetheless, Wall Street analysts are bullish about its prospects and see significant upside potential from current levels.

The improving advertising backdrop, its focus on driving user engagement, and massive cost-cutting measures are cheered by analysts. Meta stock sports a Strong Buy consensus rating on TipRanks, reflecting 41 Buy and two Hold recommendations. Analysts’ average 12-month price target of $376.19 shows 26.24% upside potential.