The market may have had a brutal correction this past Friday. However, AI remains the trade of the year. Chipmakers continue to announce huge build-outs and partnerships, with the spending race intensifying week by week. Yet one of the biggest beneficiaries of that frenzy is hiding in plain sight: Meta Platforms (META), to be more precise.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While headlines chase semiconductor supply, Meta is quietly converting AI into cash flow and product momentum. The stock, now well below its summer highs, still looks inexpensive against what’s coming. In fact, I believe a rebound to $900 is likely to occur relatively soon, which is why I remain highly bullish on Meta, my most prominent position by far.

AI At the Core of the Ad Machine

Yes, Meta is spending heavily to power AI. Management raised 2025 capex to $64–$72 billion, mainly for AI data centers and hardware, to support their artificial intelligence efforts. And clearly, the bet is showing up in ads, which is where it matters. In Q1, ad impressions rose 5% and average price per ad jumped 10%, while in Q2, impressions accelerated to +11% and price per ad rose 9%. The combo of more ads at higher prices drove the firm to record 16% revenue growth in Q1 and 22% in Q2, with EPS up 37% and 38% respectively.

Under the hood, AI is doing the heavy lifting. Meta expanded a new AI-powered ad-recommendation model to more surfaces, using more signals and longer context windows. Management reports that it’s driving ~5% more ad conversions on Instagram and about 3% on Facebook, with generative-AI creative tools now making a meaningful contribution to ad revenue. Since Meta’s system ranks content and ads for 3-plus billion people, single-digit conversion gains compound into staggering multiples.

On infrastructure, note that beyond just buying GPUs, Meta is rolling out its Meta Training and Inference Accelerator (MTIA) — basically custom silicon optimized for ranking and recommendations, with v2 bringing significant performance gains. The company also reassured us that a considerable portion of capex is allocated to such meaningful AI workloads, and not just metaverse experiments, as was the case in the past.

Glasses, AI, and a Network Effect

Where does Meta go from here? Apparently, toward “AI you can wear.” The Ray-Ban Meta smart glasses already support multimodal AI, allowing you to look at something, ask a question, and receive a real-time answer. Notably, at Connect 2025, Meta unveiled Ray-Ban Display glasses with in-lens visuals and a wrist controller, signaling a push into heads-up AI that feels practical (navigation, captions, messaging) rather than sci-fi. Early reviews and teardowns suggest the display tech is real.

Crucially, Meta’s Meta AI assistant now counts ~1 billion monthly actives, and Threads just crossed 350 million MAUs this spring, giving the company a built-in distribution network for AI features that many of its competitors would kill for. Family daily active users — the daily engagement across Meta’s family of apps — is rising steadily.

That network effect matters. Meta’s Family DAP hit 3.48 billion in Q2, an ocean of engaged users for AI-augmented discovery, shopping, and messaging. When you integrate more intelligent ranking and creative strategies onto Instagram Reels and WhatsApp business messaging, small efficiency gains can scale into significant revenue streams.

Priced Like a Slow-Grower (But It Isn’t)

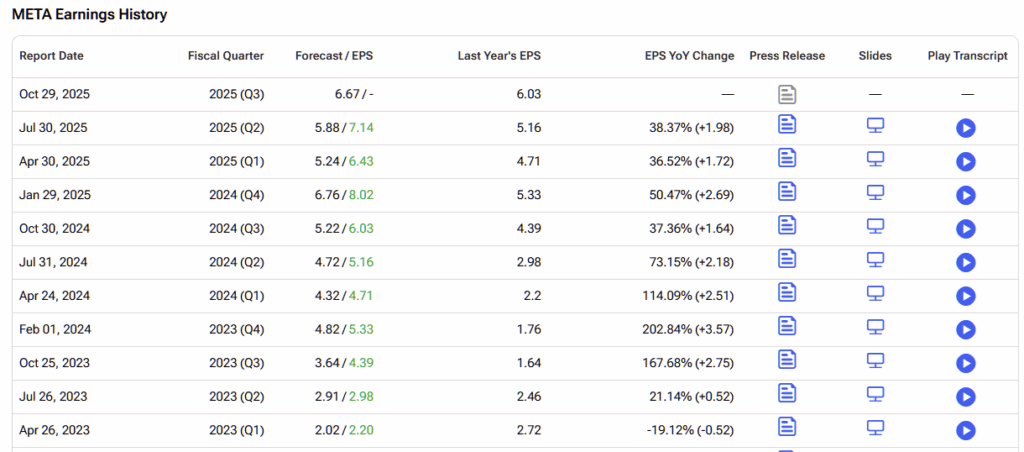

Now, here’s the disconnect. In 2023, Meta grew revenue 16% and EPS by 73%. In 2024, revenue accelerated to $164.5 billion (+22%) and EPS jumped to $23.86 (+60%). This year began with back-to-back quarters of mid-to-low-20s revenue growth and high-30s EPS growth. In the meantime, Wall Street has consistently underestimated Meta, with the company consistently delivering massive beats against estimates.

Despite that, today shares trade around $705, roughly 11% below the $796 52-week high, which I find an opportune buying point. Against consensus EPS of $28 for 2025, $29.9 for 2026, and $34.35 for 2027, the stock sits at about 25x, 23.6x, and 20.5x those years, respectively. That’s what a market prices in when it assumes growth cools to single digits, not when a company is compounding its ad yield, rolling out custom AI chips, and seeding a glasses platform into an audience of billions.

META’s P/E remains very well-placed at 25x compared to a sector median of 19x, indicating that despite the stock’s sturdy rally, there’s still more room to run.

Given Meta’s ongoing growth and leading position across various verticals, I would argue that shares could trade at or even well above 30x earnings. But even if that scenario never materializes, today’s valuation should lead to excellent shareholder returns even with modest growth ahead, let alone the 20%+ EPS hikes we are accustomed to. At $900, Meta would still trade at a reasonable 30x EPS.

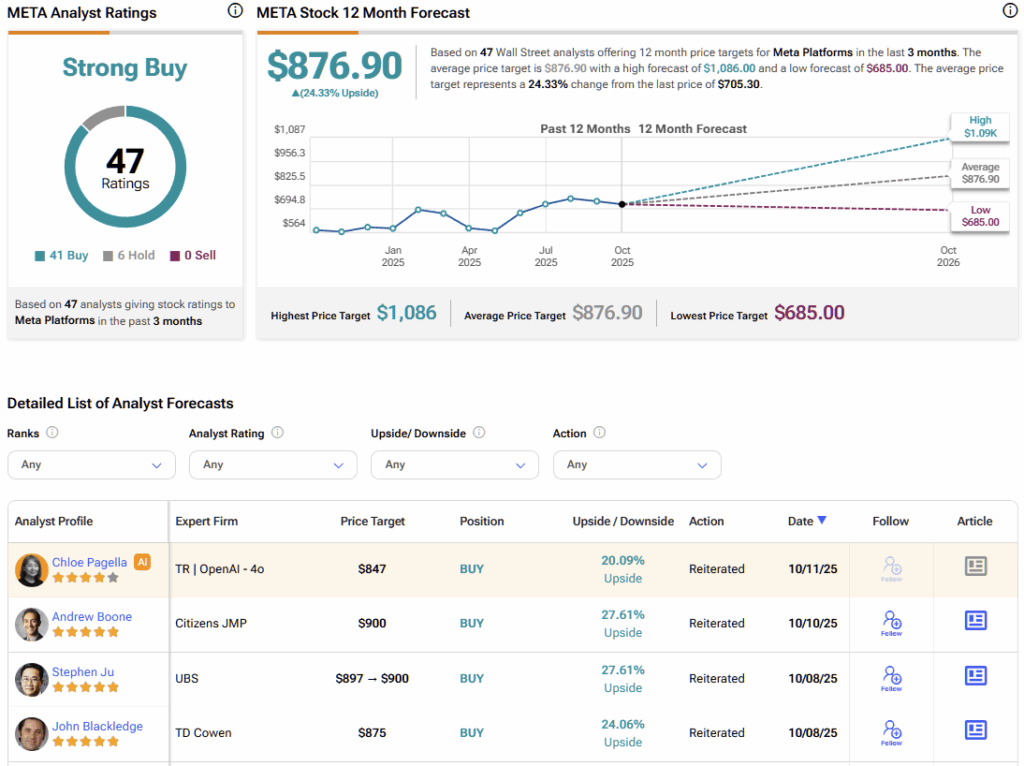

Is META a Buy, Sell, or Hold?

Wall Street remains stoutly bullish on Meta, with the stock carrying a Strong Buy consensus rating based on 40 Buy and six Hold ratings over the past three months. Notably, no analyst rates the stock a Sell. Moreover, META’s average stock price target of $877.63 suggests 25% upside from current levels.

Meta’s Gold Rush as AI Powers Stock Toward $900

Everyone’s fixated on the shovels in this gold rush (the chips), but the real gold — ad performance, engagement, and the devices people actually use — is piling up on Meta’s side of the river. The company has the audience, the AI engines, and now the hardware bridge to bring AI into daily life. With growth re-accelerating, capex focused squarely on ROI, and the stock still underpricing that reality, a price target of $900 looks entirely reasonable — possibly before year-end.