In early February, Meta Platforms (NASDAQ:META) stock added $197 billion to its market value during one session, amounting to the biggest one-day surge in U.S. stock market history. That was based on a Q4 report that showed the social media giant busting all the right moves. With the company poised to release 1Q24 results next week (April 24th), can Meta do it all over again?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That remains to be seen, although UBS’s Lloyd Walmsley, a 5-star analyst rated in the top 2% of the Street’s stock pros, thinks that heading into the print, expectations are pretty high.

“We believe investor expectations for 1Q24 total revenue stands at the high-end of the guidance range of $34.5B-$37.0B, with 2Q24 expectations for the same at ~$39B,” Walmsley opined.

Walmsley thinks it’s unlikely that the guide for operating expenses for the year will shift from the current range of $94 billion to $99 billion since we’re only one quarter in. Similarly, capital expenditures are anticipated to stay unchanged within the range of $30 billion to $37 billion.

While investor expectations are high, going by Walmsley’s ad checks, the analyst thinks the 1Q24 digital ad market got off to a slower start than anticipated with growth levels below full-year 2024 estimates. The growth is being driven by Advantage+ and Reels, although reflecting a year-over-year growth level “slightly softer than expected.” That said, Walmsley says his checks are primarily US centric, and he thinks there is room for upside in the shape of Chinese advertisers seeking to reach customers beyond their own market. This was a surprise element in the Q4 readout. All told, Walmsley expects ad revenue of $34.6 billion, amounting to a y/y increase of 23%.

Meta also continues to prioritize cost discipline even after the conclusion of its “Year of Efficiency.” UBS Evidence Lab data indicates that although there’s been an increase in job requisitions for technical roles compared to the second half of 2022 and 2023 (during which several rounds of job cuts took place at the company), they are still at only one-third the intensity of the peak hiring levels seen in 2021. This trend is even more evident when considering overall job requisitions.

“We remind investors that Meta has laid out plans to ramp hiring of technical labor this year, but overall job requisitions data suggests that the company will depress hiring levels elsewhere to compensate,” Walmsley said.

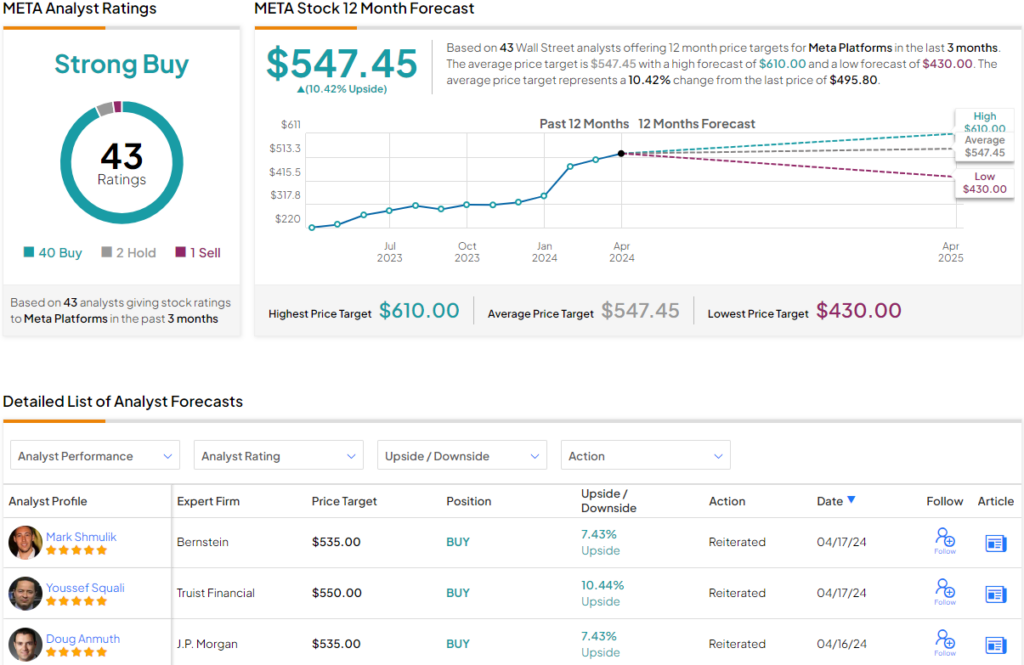

All told, Walmsley maintains a positive stance on Meta shares; in fact, he has now become one of the Street’s biggest META bulls. Accompanying a Buy rating, Walmsley raised his price target from $530 to a Street-high $610, suggesting the stock will surge 23% in the year ahead. (To watch Walmsley’s track record, click here)

Most others on the Street are also bulls; Meta’s Strong Buy consensus rating is based on a mix of 40 Buys, 2 Holds and 1 Sell. The $547.45 average price target implies shares will appreciate by ~10% from current levels. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.