Shares of Meta Platforms (NASDAQ: META) were on an upswing in pre-market trading on Tuesday after top-rated Morgan Stanley analyst Brian Nowak upgraded the stock to a Buy from a Hold with a price target of $250. The analyst’s price target implies an upside potential of 26.4% at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nowak is positive about the stock considering its renewed focus on cost efficiencies after the social media giant indicated last week that it was planning another round of job cuts and is looking at laying off around 10,000 employees and closing around 5,000 additional open roles.

The analyst also pointed out the improving revenue, engagement, and Reels trends for META as its Q4 revenues of $32.2 billion exceeded analysts’ expectations and it guided for Q1 revenues in the range of $26 billion and $28.5 billion, again ahead of consensus estimates of $27.3 billion.

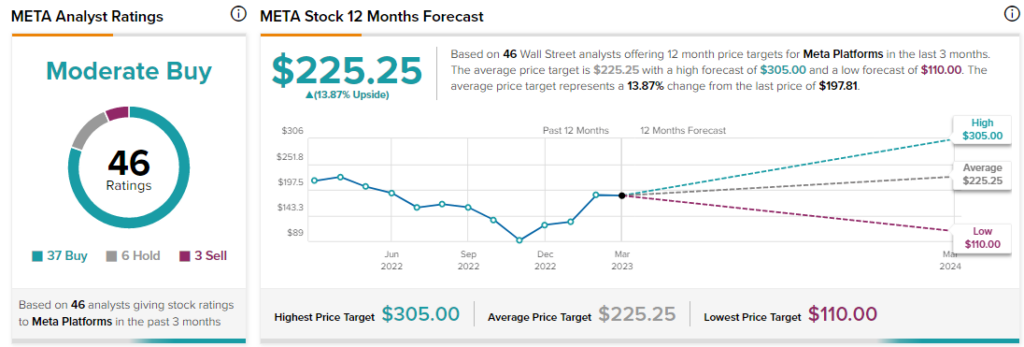

Overall, analysts are cautiously optimistic about META stock with a Moderate Buy consensus rating based on 37 Buys, six Holds and three Sells.