Shares of the technology and social media giant Meta Platforms (NASDAQ:META) maintained their uptrend in 2024, once again hitting a $1 trillion market cap. It has gained over 10% year-to-date and is up about 176% in one year. Meta stock first hit a $1 trillion market cap in 2021, driven by the COVID-led rally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The stellar bull run in Meta stock came on the back of the company’s efforts to significantly reduce its cost structure via a series of job cuts. Moreover, its aggressive investments in artificial intelligence (AI), improving user engagement, growing contribution from Reels, and recovery in ad revenues supported its financials and share price.

META to Report Q4 Earnings on February 1

Meta will release its fourth-quarter 2023 financial results after the market closes on February 1, 2024. Analysts expect Meta to post revenue of approximately $39 billion, up about 21% year-over-year. Further, Wall Street projects Meta to report earnings of $4.83 per share, up significantly from $1.6 in the prior-year quarter.

Analyst Sees Solid Growth in Q4

TD Cowen analyst John Blackledge reiterated the Buy rating on META stock ahead of its Q4 earnings. The analyst expects Meta to report solid Q4 results, with its top line surpassing the consensus estimate by 1%. Further, Blackledge expects Meta’s bottom line to benefit from higher revenues and lower operating expenses.

As for 2024, the analyst expects Reels to contribute more to its overall sales and deliver $18.1 billion in revenue. Further, Blackledge projects Reels’ revenue to increase at a CAGR of 21.5% and hit $48 billion in 2029. Additionally, the analyst expects Meta’s ad revenues to grow at a CAGR of about 10% during the same period.

What is the Stock Prediction for Meta?

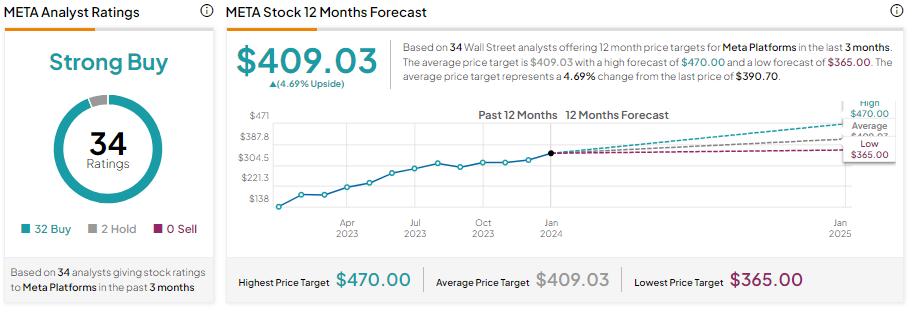

Wall Street remains upbeat about its prospects. It has 32 Buy and two Hold recommendations for a Strong Buy consensus rating. However, due to the substantial increase in Meta stock over the past year, analysts’ average price target of $409.03 implies a limited upside potential of 4.69% from current levels.