Meta Platforms (NASDAQ:META) is expanding its new microblogging platform, Threads, to European countries. This move will help the social media giant drive Threads’ monthly active users (MAUs), increase engagement, and eventually benefit its top-line numbers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Launched in July, Threads garnered nearly 100 million monthly active users by the end of the third quarter of 2023. Meta’s CFO, Susan Li, expressed optimism over the prospects of Threads during the Q3 conference call. Li highlighted that Threads is gaining popularity among users and presents a “compelling long-term opportunity” for the company.

Tigress Financial analyst Ivan Feinseth maintains a positive outlook on Threads, anticipating it to capture market share from X. Furthermore, the analyst highlights Meta’s continuous expansion of Artificial Intelligence (AI) capabilities, the ongoing success of Reels, and the introduction of Threads are expected to drive user engagement and ad revenue. Feinseth reiterated a Buy on Meta stock on November 22.

What is the Prediction for Meta Stock?

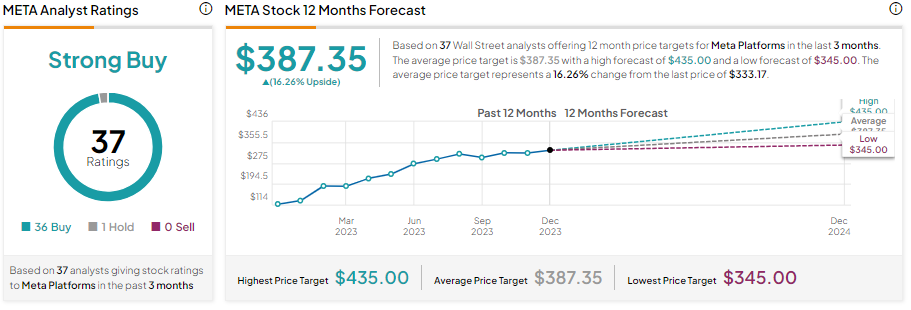

Meta stock has rallied significantly, rising 177% year-to-date. Despite this notable appreciation in value, Wall Street is bullish about its prospects. Meta’s significant investments in AI, emphasis on cost reduction, strong ad revenue, and increasing user engagement bode well for future growth and are reflected in analysts’ optimistic outlook.

With 36 Buys and one Hold, Meta stock has a Strong Buy consensus rating. Analysts’ average price target of $387.35 implies 16.26% upside potential from current levels.