Meta Platforms (NASDAQ:META) faced a major setback yesterday following a ruling by the European Court of Justice (ECJ) that has implications for the company’s ad-based business model. The court has now stipulated that Meta must acquire consent from Facebook users in the European Union before displaying specific personalized advertisements.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta relies heavily on its primary revenue stream, which involves selling advertising space on its platforms such as Facebook, Instagram, and WhatsApp. The company leverages the vast amount of data it collects from user interactions with Meta’s services to facilitate targeted advertising. Interestingly, for the year ended December 31, 2022, the company’s Advertising revenue accounted for about 97% of the company’s total revenue.

Furthermore, the European Union’s top court said that the German competition regulators acted appropriately in 2019 when they requested that Facebook modify its practices regarding the tracking of users’ internet browsing and smartphone applications.

Meta’s Mounting Legal Pressure

The ECJ’s decision is final and cannot be appealed, which has the potential to influence the resolution of other ongoing privacy cases involving Meta. It is worth mentioning that META is already appealing a €390 million EU fine for its practice of requiring users to accept personalized ads in order to access its platforms. The outcome of these cases is expected to have a significant impact on Meta’s future strategies regarding privacy and advertising practices.

Furthermore, this decision is likely to amplify the scrutiny and regulatory pressure faced by Meta in other countries concerning its data privacy and user tracking practices.

Is META a Buy or Sell?

Despite Meta’s legal troubles, Wall Street is optimistic about the stock. The Strong Buy consensus rating for Meta is backed by 36 Buys and four Holds. At $295.53, the average META stock price target currently implies 3.32% upside potential.

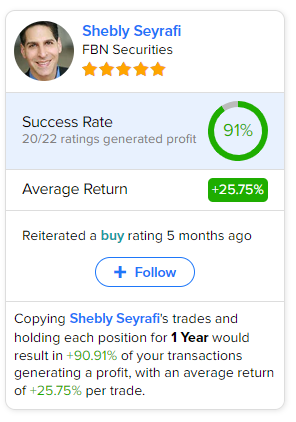

Investors looking for the most accurate and profitable analyst for META could follow FBN Securities analyst Shebly Seyrafi. Copying the analyst’s trades on this stock and holding each position for one year could result in 91% of your transactions generating a profit, with an average return of 25.75% per trade.