Shares of Meta Platforms (NASDAQ:META) are trading higher at the time of writing, thanks to encouraging comments from Citi analyst Ronald Josey. According to Josey, both engagement and revenue-generating activity on Instagram are on the rise. Despite quarterly Instagram downloads being 12% less than TikTok, Instagram managed to secure a higher user base increase, with a 6% year-over-year growth in monthly active users compared to TikTok’s 4%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Josey further highlights that Instagram users are devoting more time to the platform, even though TikTok still dominates in terms of total user hours. With seven months of consecutive growth in user hours, Instagram is slowly closing the gap. In addition, Instagram’s Reels feature is garnering more attention, with 17-18% of its content now composed of ads. Josey predicts that advertising revenue growth will increase by 14% year-over-year in 2024, with Reels generating around $10.5 billion in revenue next year.

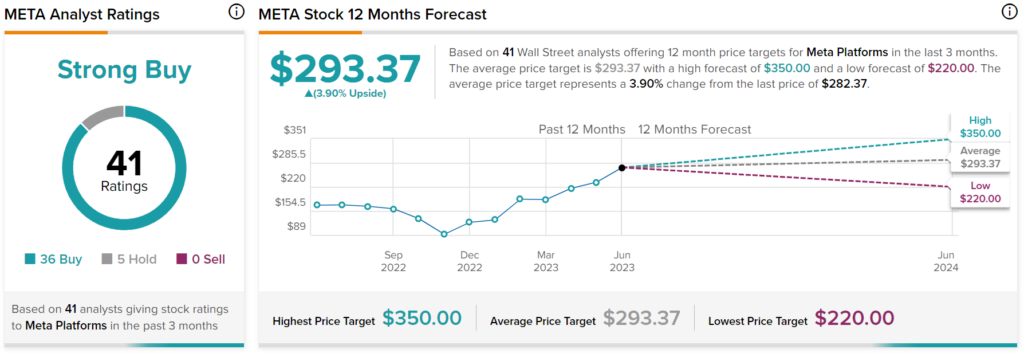

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 36 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $293.37 per share implies 3.9% upside potential.