Meta Platforms (NASDAQ:META) is facing some troubles in the European Union. Specifically, a new set of antitrust violations cropped up early Monday and left Meta shares on the back foot. This time, the European Union is targeting Facebook Marketplace because it offers Marketplace access automatically as part of holding a Facebook account.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In so doing, Union officials note, other classified ad services have less ability to connect with customers. After all, why go looking for a classified ad board when Facebook has its own, ready to go.

Moreover, it can use that data to serve up better ads, which improves Facebook’s value indirectly and also puts competitors at a further disadvantage. Should Facebook be found in violation of European Union rules around antitrust behavior, Facebook could be fined as much as 10% of its annual revenue.

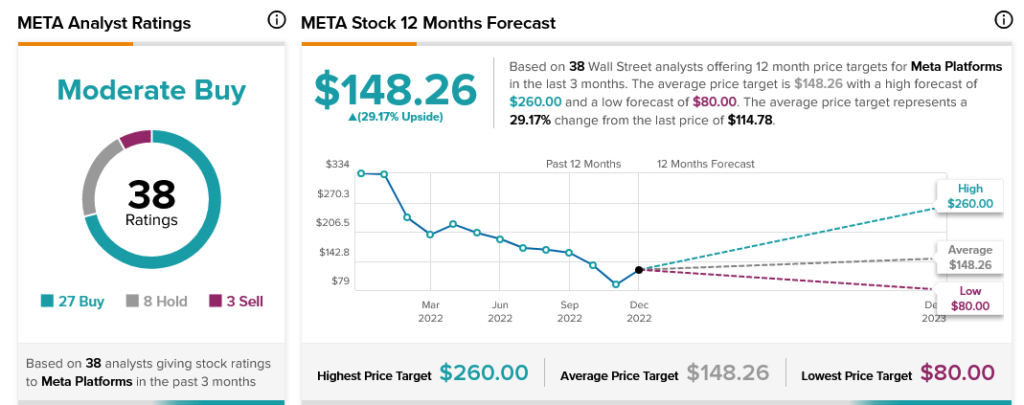

This isn’t the first time Facebook has faced such problems. Nevertheless, Wall Street analysts have a consensus price target of $148.26 on META stock, implying 29.17% upside potential, as indicated by the graphic above.