Meta Platforms (META) has signed its largest-ever funding agreement, a $27 billion deal with asset management firm Blue Owl Capital (OWL) to develop a massive new data center in Louisiana. The two companies have formed a joint venture (JV) in which Blue Owl will contribute approximately $7 billion in cash, while Meta will receive a one-time payout of $3 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both parties will fund their proportional shares of the roughly $27 billion needed for the campus’s buildings and core infrastructure. Meta has contributed land and ongoing construction assets from the project to the new joint venture. The Instagram owner will retain a 20% equity stake in the JV, with Blue Owl holding the remaining majority interest.

Meta will oversee the construction and property management of the project, known as Hyperion, located in Richland Parish, Louisiana. Once complete, Hyperion is expected to deliver more than 2 gigawatts of computing power to support the training and inference capabilities of advanced artificial intelligence (AI) models.

Meta Builds its Largest-Ever Data Center

Meta is moving swiftly to construct what will be its largest data center to date, spanning roughly 4 million square feet and scheduled to go live by 2030. In a statement on Tuesday night, the company said the partnership with Blue Owl provides it with “the speed and flexibility” to execute a project of this scale, aligning with Meta’s broader AI infrastructure strategy.

Meta has signed a four-year land lease, with an option to extend, and will have exclusive rights to use the facility once operational. Financing the deal through a JV allows Meta to keep much of the project off its balance sheet, a move analysts view as financially prudent.

A portion of capital raised by Blue Owl will be funded by debt issued to major institutional investors. BlackRock (BLK) is reported to have purchased about $3 billion in Hyperion-related bonds, while bond giant PIMCO acquired approximately $18 billion. The debt instruments carry one of S&P’s highest credit ratings of A+, underscoring investor confidence in Meta’s backing.

AI Infrastructure Race Intensifies

The Hyperion project underscores Meta’s drive to expand computing capacity amid the escalating AI arms race among major technology players. Companies such as Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), OpenAI, and Meta are all investing heavily in next-generation data centers to support large-scale machine learning models. By securing this record-breaking financing, Meta strengthens its position in the global competition for AI infrastructure leadership.

Is META a Good Stock to Buy Right Now?

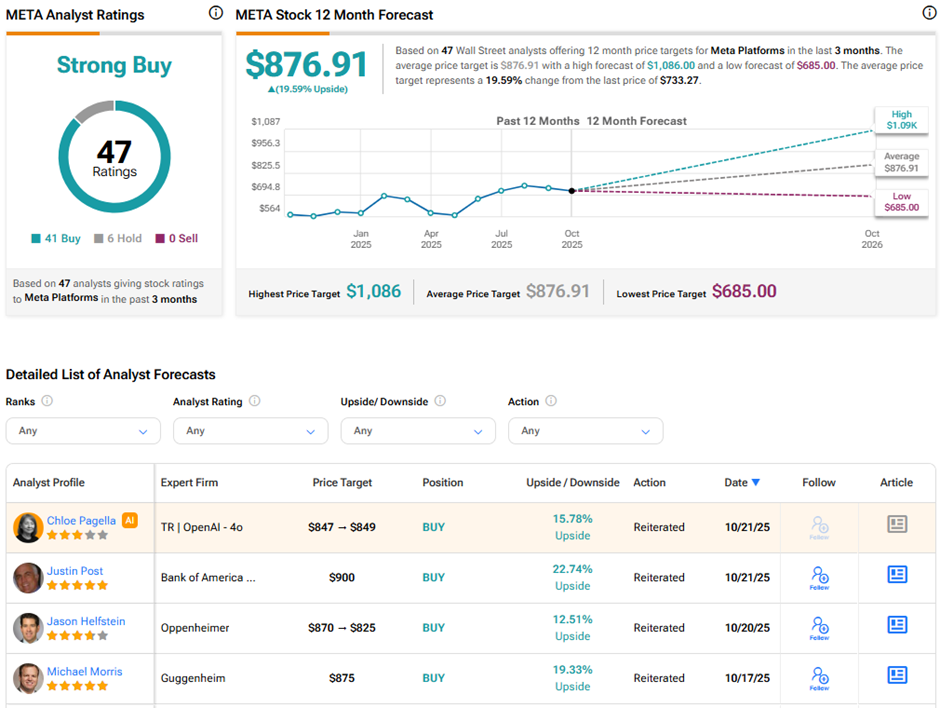

Wall Street remains highly optimistic about Meta Platforms’ long-term potential. On TipRanks, META stock has a Strong Buy consensus rating based on 41 Buys and six Hold ratings. The average Meta Platforms price target of $876.91 implies 19.6% upside potential from current levels. Year-to-date, META stock has surged 25.5%.