Meta Platforms (META) removed a Facebook group on Tuesday after the Department of Justice (DOJ) told the social media giant that the group was being used to “dox and target” ICE agents in Chicago. Attorney General Pam Bondi shared the news on X by saying that the DOJ will keep working with tech companies to take down platforms where people promote violence against federal law enforcement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Meta spokesperson confirmed that the group was taken down for violating company rules regarding “coordinated harm” and “promoting crime,” but did not share details about how big the group was or exactly what content led to its removal. Meta’s actions come as tech platforms try to limit content that could encourage real-world threats. Other tech companies have made similar moves recently.

For example, Apple (AAPL) took down the ICEBlock app, which was meant to report sightings of ICE agents, after Bondi said that it endangered officers. Apple stated that it acted based on safety concerns raised by law enforcement. Separately, Google (GOOGL), though not contacted by the DOJ, also removed similar apps for breaking its rules. Meanwhile, ICEBlock creator Joshua Aaron criticized both Apple and the White House by saying that the removals are a threat to Americans’ constitutional rights and compared his app to Waze, which lets users report police to avoid speeding tickets.

Is Meta a Buy, Sell, or Hold?

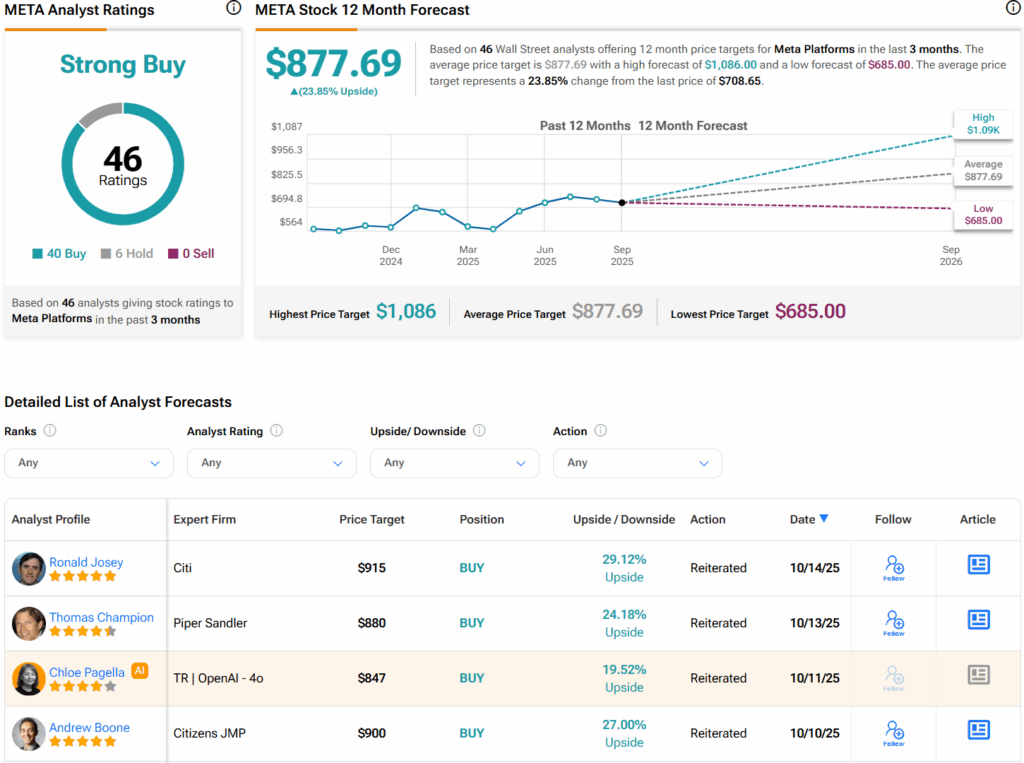

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 40 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $877.69 per share implies 23.9% upside potential.