Another day, another 90-day catalyst watch from Citi kicks in. This time it’s for social media giant Meta Platforms (NASDAQ:META), which landed the latest Citi nod. This time, it actually had a positive impact, as Meta shares were up over 3% in Friday morning’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With next week’s Meta Connect event poised to arrive and bring with it a string of new developments, Citi’s Ronald Josey not only kept his earlier ratings in place—a Buy rating with a price target of $385 per share—but he also added Meta to the list of stocks to watch in the next three months. The biggest reason was, not surprisingly, the Meta Connect event. That should provide quite a bit of insight into the stock’s likely near-term potential. It wasn’t just that, though, as Josey also noted that ad loads are on the rise, though not quite as sound as those found on TikTok.

Meta is also stepping up its connection to businesses, who are already using Meta’s Facebook and Instagram as promotional venues. Meta is adding Meta Verified access to businesses, which should help draw in new business users. It was formerly available only to creators, but for $22 a month, your business will also be able to tell its Meta users that, indeed, it is who it says it is. $35 a month, meanwhile, lets users do that on both Facebook and Instagram. WhatsApp, on the other hand, will come later.

What is the Forecast for Meta Stock?

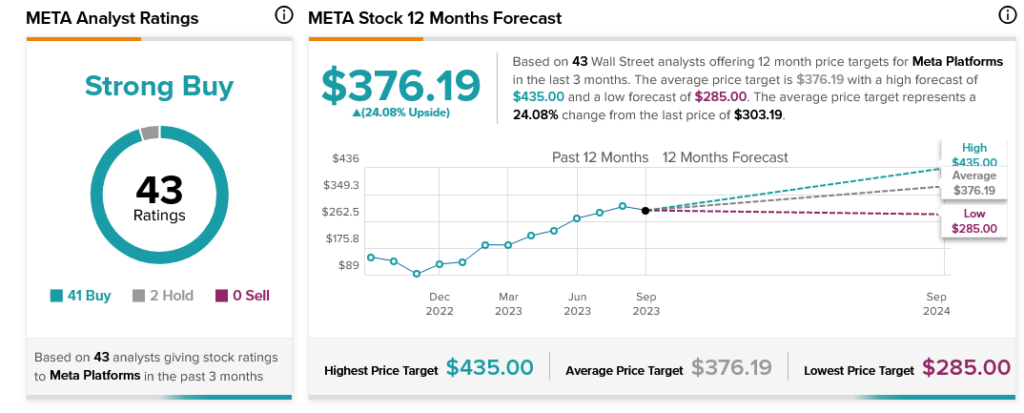

Meta Platforms still enjoys widespread analyst support, and with all that going on, it’s small wonder why. Meta Platforms stock is currently considered a Strong Buy by analyst consensus, with 41 Buy ratings and two Holds to support it. Meta Platforms stock also offers 24.08% upside potential thanks to its average price target of $376.19.