Ever see one of those clickbaity lists featuring some item that you just “won’t believe?” I think I’ve got one for you now: Mark Zuckerberg, the founder of social media giant Meta Platforms (NASDAQ:META), recently tested the Apple (NASDAQ:AAPL) Vision Pro headset. Unsurprisingly, Zuckerberg prefers the Meta Quest 3 headset, and Meta ticked up nearly 2% in Wednesday morning’s trading as a result.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Zuckerberg at least managed to have some objective reasons why he found his own product superior to that of his direct competitor in the space. He cited the overall weight of the product, noting that the Quest 3 was more lightweight than the Vision Pro. Zuckerberg also called attention to a more “…immersive content library” with the Quest 3 than its competitor.

Perhaps in a move to not make this seem like the work of an obvious shill, Zuckerberg did cite the superior display resolution on the Vision Pro and noted that the Vision Pro has eye tracking that the Quest 3 lacks. At least for now, as there were signs that the feature would come later to the Quest 3. However, Zuckerberg immediately tamped that down by declaring the Quest 3’s physical hand controllers superior to eye tracking anyway.

Why Did He Even Bother?

There was one huge difference that Zuckerberg could have pointed out that could win the argument on its own: the price tag. The Meta Quest 3 comes in at a hefty, but still doable, $499. Meanwhile, the Vision Pro is about seven times more than that, at $3,499. Zuckerberg probably could have blown the whole argument out of the water by declaring the Vision Pro a superior product, but one priced so onerously that it was worth buying the Meta Quest 3.

Is Meta a Buy, Sell, or Hold?

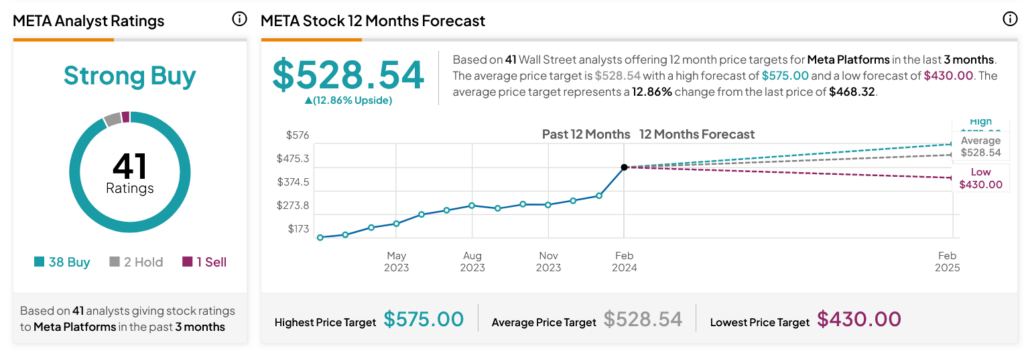

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 38 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 163.47% rally in its share price over the past year, the average META price target of $528.54 per share implies 12.86% upside potential.