Meta Platforms (META) is a member of the Magnificent Seven and known for its social media sites such as Facebook and Instagram. While the stock has generated strong returns for shareholders over the past year, its momentum has waned in the last six months, leading to the share price stagnating. The loss of momentum comes even though Meta has demonstrated that its AI investments are beginning to pay off. Despite the stock losing some steam, I remain bullish on Meta Platforms because of the company’s strong position in AI, competitive moat, and cash balance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta’s Momentum

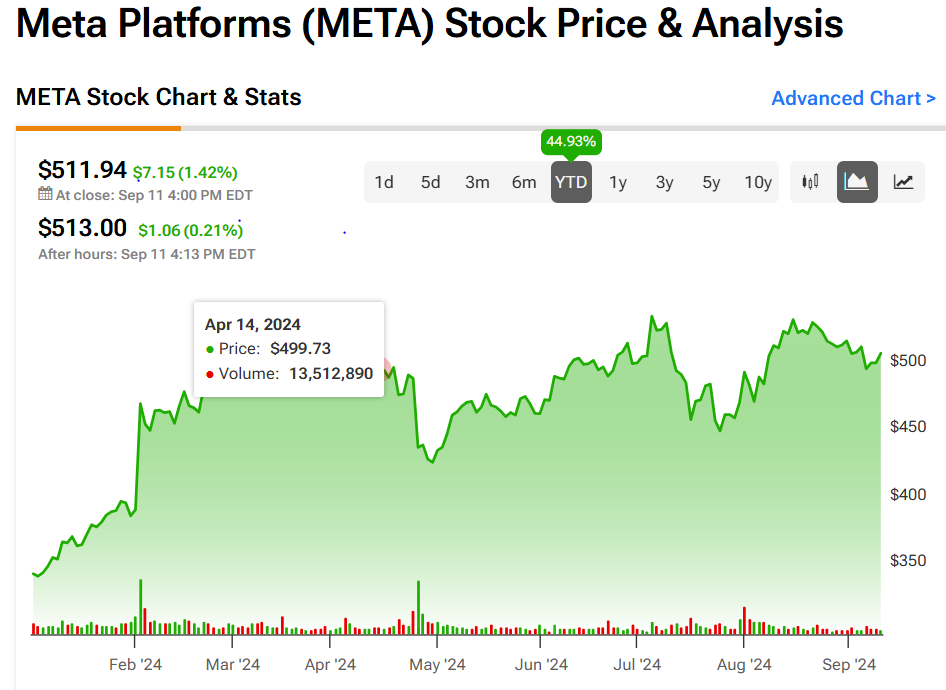

Meta’s waning momentum hasn’t deterred my bullish outlook for the company and its stock. Despite falling from its peak this spring, META stock is up 45% on the year. The technology giant’s shares have traded near $530 on three occasions since April. But each time, the share price has fallen back to the $500 mark and remains rangebound.

Momentum and sentiment are important indicators for many investors. Looking at the last six months, this declining momentum can clearly be seen in the stock’s falling Relative Strength Index score, which is now at 38. This is one of the reasons why Meta’s stock has been downgraded in recent months.

There are several reasons why momentum is slowing, including concerns about the company’s high capital expenditures on AI. Currently, the stock is trading around 23.7 times forward earnings and has a price-to-earnings-to-growth (PEG) ratio of 1.33. This doesn’t look to me like the stock is overvalued, but I understand that these numbers can appear expensive to some investors, especially since a PEG ratio greater than 1.00 is generally considered overpriced.

Meta’s Bull Thesis

I remain bullish on Meta Platforms largely because it is a quality company. Meta retains a dominant position in social media, with platforms such as Facebook, Instagram, and WhatsApp providing the company with more than three billion monthly active users. That’s nearly half the world’s population and provides the company with a big competitive moat that continues to attract advertisers.

At the same time, Meta’s investments in AI appear to be paying off, as evidenced by the 22% year-over-year revenue growth in this year’s second quarter. Meta has sought to integrate AI into its advertising technologies, which has led to improved ad targeting and effectiveness, resulting in higher ad prices and better returns for advertisers.

Finally, the company’s financial strength is impressive, with a net cash position of nearly $40 billion and strong free cash flow generation. It’s this financial strength that has allowed Meta to invest so heavily in AI. The strong cash position will enable management to invest in additional growth areas moving forward.

The Bearish View

While I remain bullish on META stock, not everyone shares my viewpoint. Despite the positives I’ve mentioned, some investors are content to focus on the company’s drawbacks. These include massive investments in AI and the metaverse, much of which is speculative and runs the risk of sizable losses. The metaverse, more than AI, has been a loss-making part of the business for some time, and it’s unclear when the situation might improve.

Additionally, there is a risk that economic uncertainties in the U.S. and elsewhere could lead to reduced advertising spending on Meta’s social media sites, impacting the company’s finances. This could be a near-term issue with the U.S. economy softening and China in an economic slowdown.

Some analysts note that, with more than three billion monthly active users, Meta’s social media platforms might be nearing saturation, limiting future growth potential. Competitors such as TikTok continue to challenge Meta’s dominance in the social media space, especially among younger consumers.

Is Meta Stock a Buy or Sell?

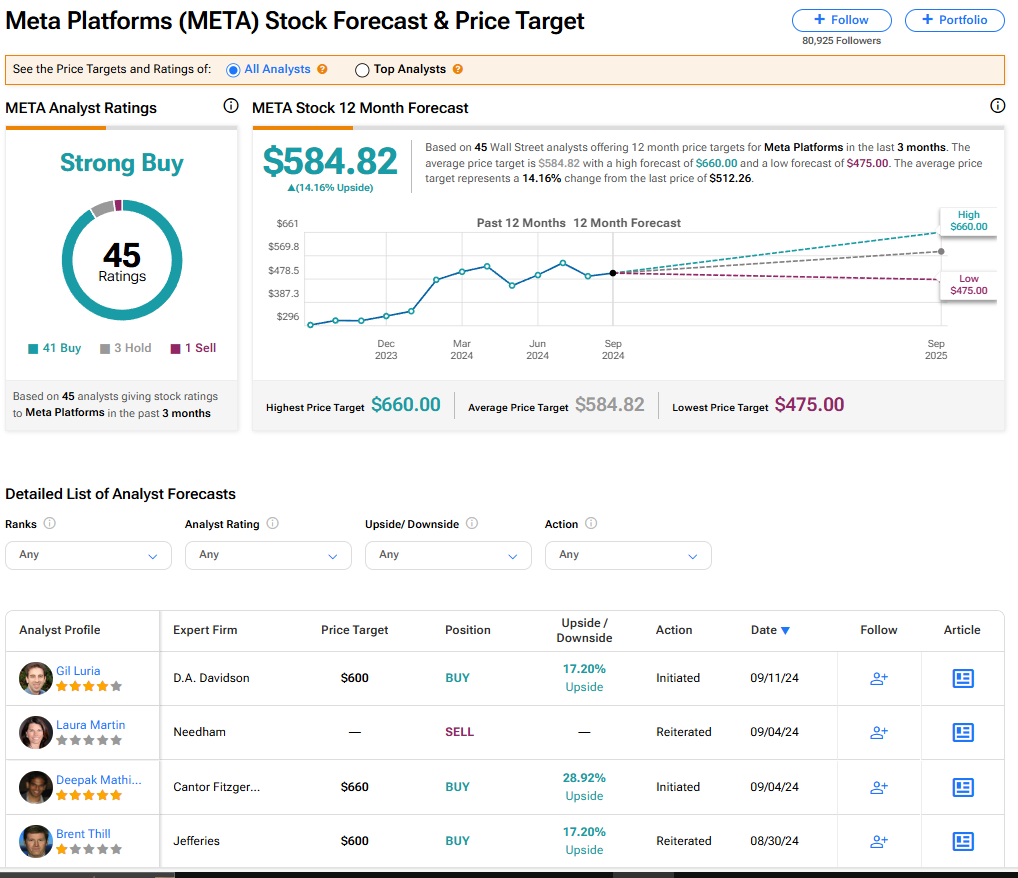

On TipRanks, Meta Platforms has a Strong Buy rating based on 41 Buy, three Hold, and one Sell rating assigned by analysts in the past three months. The average Meta Platforms stock price target is $584.82, implying 14.16% upside from current levels.

Conclusion

Meta’s stock has lost some momentum, and, as a result, it is no longer a top pick among many analysts. The company is also facing competition from the likes of TikTok, and its investments in the metaverse have been disappointing. However, I still believe Meta Platforms is an attractive and interesting investment opportunity. It’s one of the richest companies in the world with a huge cash balance and it’s a clear beneficiary of the AI revolution. Very few companies can say the same. For these reasons, I remain bullish on META stock.