Virtual reality has captured imaginations since the 1990s. Those simple days of massive headsets, “Dactyl Nightmare,” and $5-per-play games left us wondering what could be done. But for Meta Platforms (NASDAQ:META), it’s been something of a disappointing trip. Still, up over 1.5% in Tuesday morning’s trading, it’s clear that investors aren’t exactly displeased, even as the market falls apart under their very feet. The VR market, notes a report from Circana, is in open decline.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales of both virtual reality headsets and augmented reality glasses—another innovation that’s starting to fall flat—are in freefall. As of November 25, sales of both hardware lines are down around 40%, and Meta Platforms is burning vast piles of capital—billions of dollars per quarter by one report—to build a market that no one seems all that interested in. While certainly, Meta Quest 3 sales have done some good to bolster Meta’s VR ambitions, it’s still barely a patch on the sluggish sales seen so far in 2023.

The Digital Advertising Sector is Making a Comeback

If this sounds like a disaster in the making, it probably should. But while it’s a disaster in isolation, it’s actually not that big a problem in aggregate. Why? Because of diversification. Even as Meta Platform’s VR market is in open decline, several of its other operations are doing rather well. With some signs that the digital advertising sector is making a comeback, Facebook and Instagram are getting a bit of a second wind.

Indeed, Meta’s projected earnings per share growth is around 45.6% this year, which is well beyond the industry average of 39.7%. Its asset utilization ratio is also looking sharp, and earnings estimate revisions may ultimately work in its favor. There’s quite a bit to like about Meta Platforms, and that may explain why investors were piling in even as its VR reports were looking sour.

What is the Fair Value of Meta Stock?

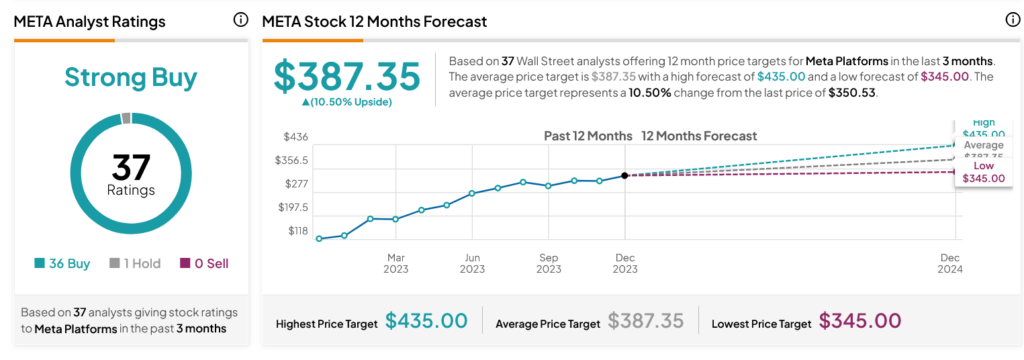

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 36 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 199.06% rally in its share price over the past year, the average META price target of $387.35 per share implies 10.5% upside potential.