While yesterday’s Meta Connect event gave social networking giant Meta Platforms (NASDAQ:META) a chance to show off its latest hardware, it did something perhaps even more impressive: it got analysts recognizing the company’s new “AI foundations.” That was enough to spark investors’ imaginations, which sent Meta Platforms stock up over 2% in Thursday morning’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Several analysts weighed in with commentary about the newfound connection between Meta Platforms and AI. Brian Nowak with Morgan Stanley noted that, so far, the advancements Meta has shown off are “impressive” and would likely make for new use cases and revenue streams from there. Nowak was hardly alone in this assessment, as other analysts pointed out the growing AI presence at Meta. Some took notice of the new hardware coming out, like the Quest 3 headset and the new Ray-Ban connection, but almost every analyst involved noted the AI systems poised for release.

In fact, one analyst referred to Meta Platforms as a “one-stop AI shop,” a move that could give it some impressive new branding and marketing opportunities to come. Perhaps even better for investors, all of this comes at a time when Meta Platforms is frantically trying to reduce capital expenditure. Remember all those job cuts over the last several months? When it seemed like someone was getting let go every day? All of those lost jobs—a tragedy for the individual, certainly—add up to cost savings, and with more revenue streams coming in, that means profit.

What is the Future of Meta Stock?

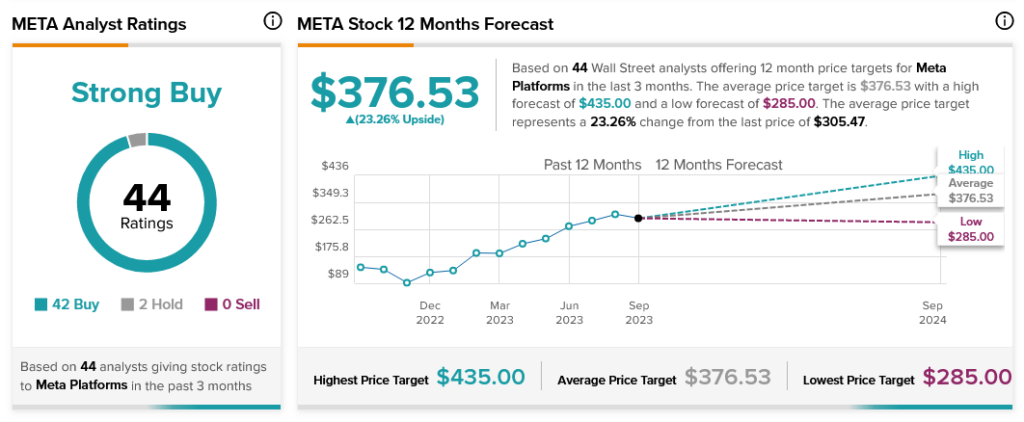

Turning to Wall Street, Meta Platforms stock is considered a Strong Buy, supported by a consensus of 42 Buy ratings and two Holds. Further, Meta Platforms stock offers 23.26% upside potential on its average price target of $376.53.