These days, social media giant Meta Platforms (NASDAQ:META) is hard at work cooking up an almost disturbing array of new hardware. In fact, it’s got at least a couple of irons already in the fire that, if they’re fully realized, could represent serious game-changers in a couple of industries. Investors, meanwhile, are skeptical, and Meta shares were down nearly 2% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first major development from Meta is already in the works, a headset that will take the combination of cameras and artificial intelligence to produce a system that can view its environment and produce information therein. The headset system could be used for several purposes, starting with identifying objects and going all the way to translating languages.

These are not exactly new purposes, of course; augmented reality was already promising object identification from a smartphone camera’s scan, and language translation has come a long way. But compressing it all into a single headset isn’t half bad, either.

It Can Read Your Mind

The next piece, however, is a bit more disturbing. Especially when added on to the first piece. The second bit is a project Meta is working on that focuses on decoding brain activity. In fact, Meta is actively backing tech that can detect brain activity without any kind of surgery. The potential for use—and misuse—here is downright alarming; imagine advertising tech that can notice you’re interested in a product from a mere glance and tailor your advertising accordingly.

Is Meta Platforms a Buy, Sell, or Hold?

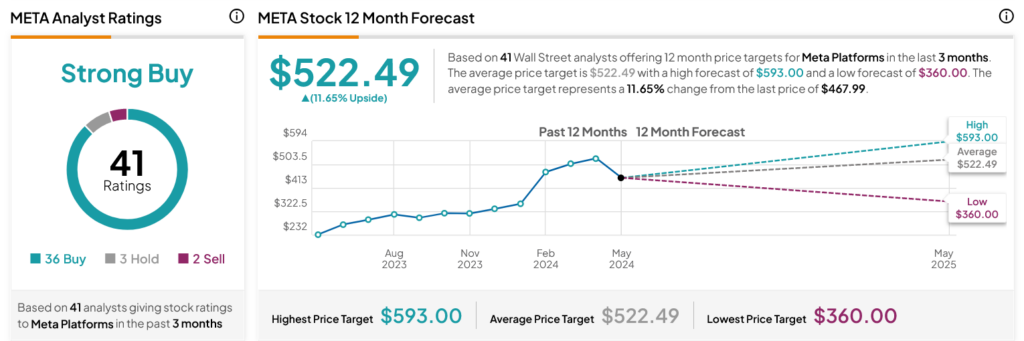

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 36 Buys, three Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 95.67% rally in its share price over the past year, the average META price target of $522.49 per share implies 11.65% upside potential.