A U.S. federal judge has ordered Israeli spyware company NSO Group to stop trying to access WhatsApp, owned by Meta Platforms (META). The decision ends a six-year legal fight that began when Meta accused NSO of breaking into its messaging service. Judge Phyllis Hamilton also reduced the damages that NSO must pay, cutting them from about $167 million to $4 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The ruling gives Meta a clear legal win, but it could also threaten NSO’s future. The company said the order may put its entire business at risk, since its Pegasus spyware depends on exploiting common software platforms. Pegasus has been linked for years to government surveillance programs that targeted journalists and activists. Meta’s head of WhatsApp, Will Cathcart, said the ruling ensures that NSO will never target WhatsApp users again.

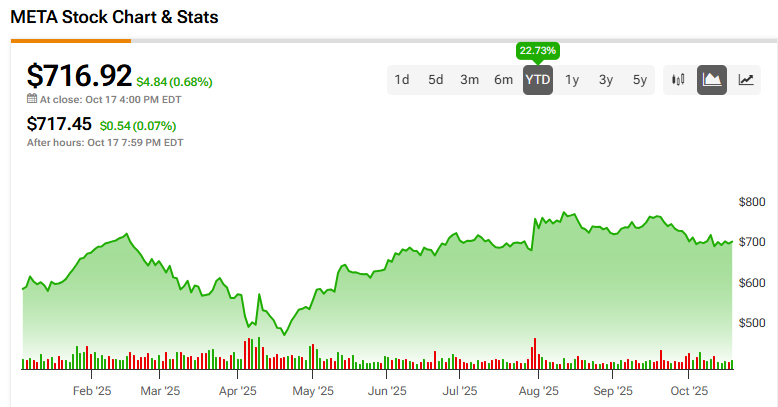

Meanwhile, META shares rose a modest 0.68%, closing at $716.92.

A New U.S. Investor Takes Control

Recently, NSO confirmed that a U.S. investment group led by Hollywood producer Robert Simonds had purchased a controlling stake in the company. Calcalist, an Israeli financial outlet, reported earlier that the deal is valued in the tens of millions of dollars. NSO said the investment does not change its location or its oversight by Israeli authorities. Its headquarters and core operations will stay in Israel and remain under the country’s defense regulations.

The change in ownership also brings a leadership shift. NSO’s co-founder and executive chairman, Omri Lavie, will leave the company as part of the deal. Simonds did not comment on the transaction, and NSO declined to name the investors involved.

NSO has faced global criticism for how its spyware has been used. Groups such as Amnesty International and the University of Toronto’s Citizen Lab have documented how governments deployed Pegasus against critics and human rights workers in several countries. NSO has said its tools are meant to help law enforcement fight crime and terrorism.

The company was already on the U.S. Commerce Department’s Entity List, which limits trade with American firms. It has tried to reverse that ban, including through lobbying efforts earlier this year. The new court order adds to its challenges by banning direct contact with one of the world’s largest communication platforms.

What It Means for Investors

For Meta, the ruling is another step in protecting its user base and privacy record. The company continues to emphasize security across WhatsApp and its other apps. For NSO Group, the reduced fine offers short-term relief, but the permanent injunction could hurt long-term business prospects. The outcome also shows how legal and regulatory pressure can reshape parts of the surveillance technology market, a space that continues to draw both investor and government attention.

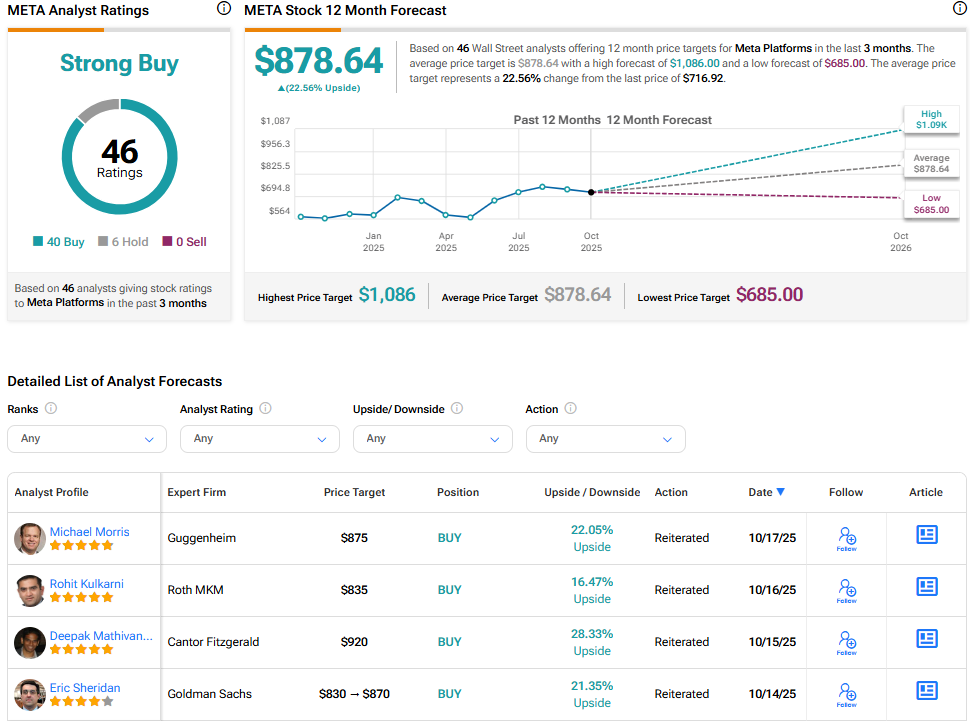

What Is the Price Target for Meta Stock?

On the Street, Meta continues to hold the analysts’ backing with a Strong Buy consensus rating. The average META stock price target is $878.64, implying a 22.56% upside from the current price.