Meta Platforms (META) is buying privately held microchip startup Rivos in order to boost its internal semiconductor development and gain more control over its artificial intelligence (AI) infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rivos develops graphics processing units (GPUs), the type of microchip that powers most AI-related work. While Meta already has an internal team building microchips and processors for AI development, the company continues to spend billions of dollars to buy GPUs from external partners such as Nvidia (NVDA).

The financial terms of the acquisition were not made public. However, Rivos was seeking new funding at a $2 billion valuation in August of this year. The acquisition is the latest example of Meta Platforms’ aggressive capital expenditures on AI. The company has pledged to spend more than $600 billion on AI over the next three years.

AI Deals

This purchase of Rivos appears to be part of Meta Platforms’ broader effort to reduce its reliance on external chip suppliers such as Nvidia for its AI operations. The acquisition of Rivos was disclosed on the same day that Meta announced another significant AI-related deal.

Separate to the Rivos purchase, Meta announced that it has reached a $14.2 billion AI cloud infrastructure deal with CoreWeave (CRWV), which operates data centers. CoreWeave makes money by building and renting out data centers that are full of Nvidia’s chips, which are key for training models and running large AI workloads.

Meta has an option to dramatically expand its computing capacity with CoreWeave through 2032, the companies disclosed in announcing the partnership.

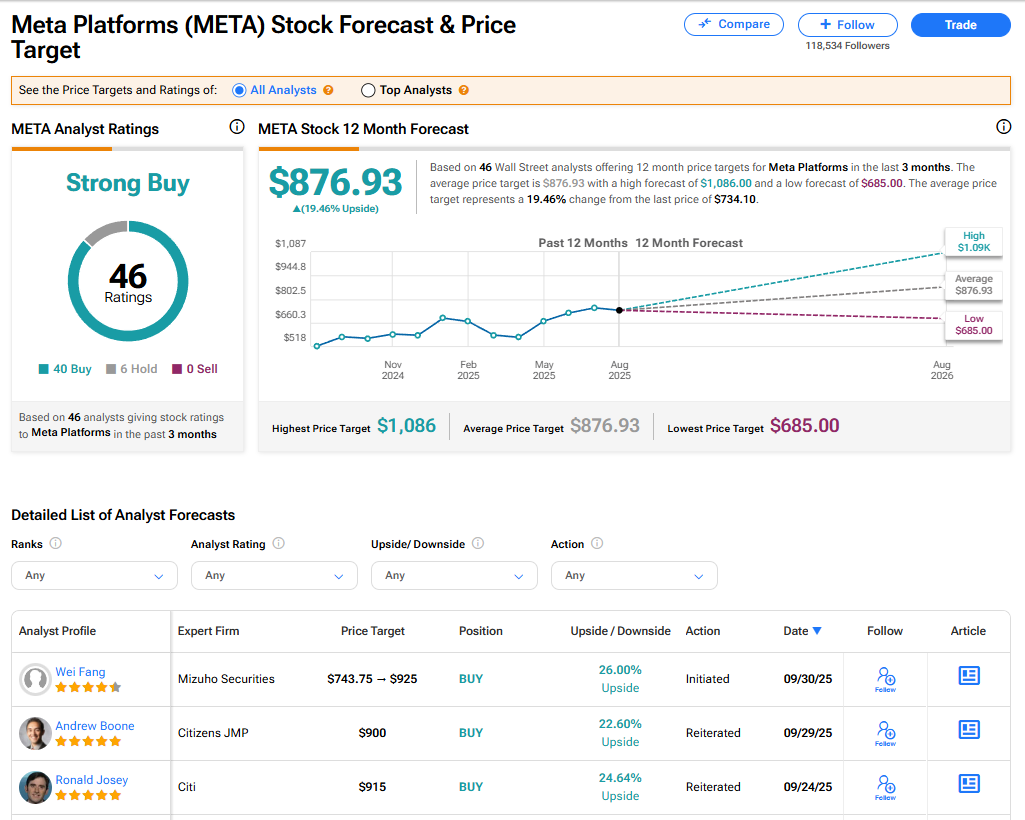

Is META Stock a Buy?

The stock of Meta Platforms has a consensus Strong Buy rating among 46 Wall Street analysts. That rating is based on 40 Buy and six Hold recommendations issued in the last three months. The average META price target of $876.93 implies 19.46% upside from current levels.