Barclays analyst Ross Sandler sees Meta Platforms (META) as well poised for a boost in advertising revenue over the next two years, driven by its platforms, WhatsApp and Threads. The analyst projects that they can generate an additional $25 billion in revenue for Meta between 2026 and 2027. He reiterated a Buy rating on Meta stock with a price target of $810.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Specifically, Sandler sees up to $6 billion in ad revenue from WhatsApp in 2026 and $19 billion from Threads in 2027. While he did not adjust official forecasts, the analyst believes Meta can beat consensus growth estimates of 16% in 2026 and 15% in 2027.

Revenue Upside from WhatsApp and Threads

WhatsApp Status ads, in particular, could open up a huge amount of ad space, reaching over 1.5 billion daily users. However, Sandler noted that ad rates (CPMs) may be lower than those on other Meta surfaces due to geographic mix and limited targeting signals.

Meanwhile, Threads, though smaller in scale, could earn higher revenue per user as its audience is concentrated in regions with stronger ad spending.

The analyst also considered the potential for some pricing pressure in 2026 as the new ad inventory comes online. However, he believes Meta’s advanced AI tools like Andromeda and GEM/Lattice will keep improving ad results and help drive more growth beyond current forecasts.

Lastly, Meta’s AI efforts are seen as a “call option”, a potential bonus. Sandler did not include any revenue from the AI assistant in his current valuation.

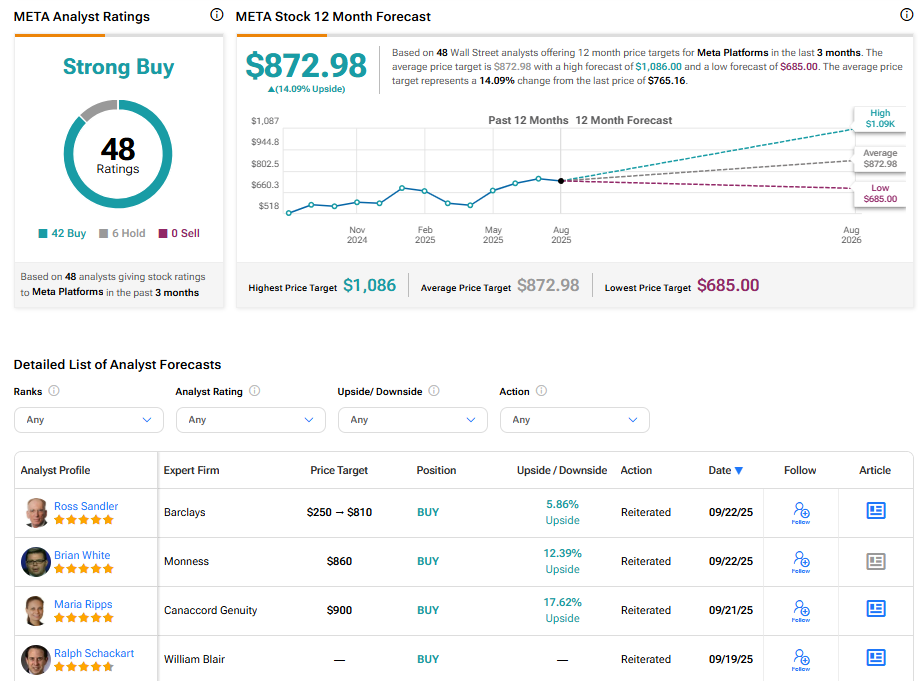

Is META Stock a Buy or Sell Right Now?

Turning to Wall Street, META stock has a Strong Buy consensus rating based on 42 Buys and six Holds assigned in the last three months. The average Meta share price target is $872.98, which implies an upside of 14.09% from current levels.