Meta Platforms (NASDAQ:META) is revising its employee performance review process and plans to reduce the bonuses of certain employees who are assigned a rating of “met most expectations” in their 2023 year-end reviews, the Wall Street Journal reported, citing an internal memo. The social media giant is cutting costs and streamlining processes as macro pressures continue to impact business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per an internal memo, the bonus multiplier for employees with “met most expectations” rating has been cut to 65% from 85% and they will receive lower restricted stock award due in March 2024. Further, Meta will now assess staff performance twice a year. The company’s review process is due to start in June and conclude in July.

“These updates reflect changes we’re making based on what we learned about the process in 2022 and what we’re optimizing for in the year ahead,” the company said in the internal memo.

Meta is calling 2023 the “year of efficiency.” The company is aggressively slashing expenses and closing unprofitable and low-priority projects. The company recently announced that it would remove 10,000 employees, marking the second round of layoffs following the announcement of 11,000 job cuts in November.

Macro headwinds have impacted digital ad spending and hit Facebook parent Meta and other social media companies like Snap (NYSE:SNAP). Meta’s investors have also been concerned about its huge investments in Metaverse projects.

Is Meta Stock a Buy?

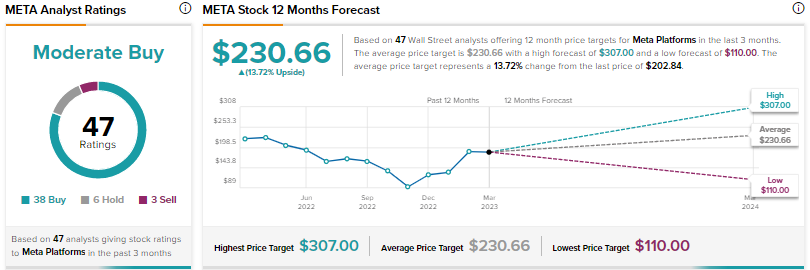

Meta scores a Moderate Buy consensus rating based on 38 Buys, six Holds, and three Sells. The average price target of $230.66 suggests nearly 14% upside. Shares have rallied over 67% since the start of 2023.