Social media and technology giant Meta Platforms (NASDAQ:META) paid £149 million, or $181 million, in penalty for terminating a lease for a London office space. British Land, which owns a portfolio of high-quality commercial properties in the U.K., said that Meta surrendered one of the two buildings it leased from the company at 1 Triton Square.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta’s withdrawal from office space can be attributed to the shift towards a hybrid work environment. Moreover, this might also be part of Meta’s broader cost restructuring plan. Meta is proactively reducing costs and focusing on increasing efficiency to cushion its earnings. Further, the company is deploying resources towards more compelling opportunities, like generative AI (Artificial Intelligence).

Investors should note that Meta plans to introduce AI chatbots to drive engagement on its platforms and woo younger users. Further, the company plans to launch several new AI-powered tools this year and has invested billions in AI infrastructure. These investments have started to pay off by driving monetization tools. The company will provide more updates about its AI initiatives at the META Connect conference (a two-day event on AI and virtual, mixed, and augmented realities slated to begin today).

As Meta Platforms focuses on reducing costs on projects that may no longer be as crucial and commits to AI investment and utilization, let’s look at what the Street recommends for its shares.

Is Meta Stock Expected to Rise?

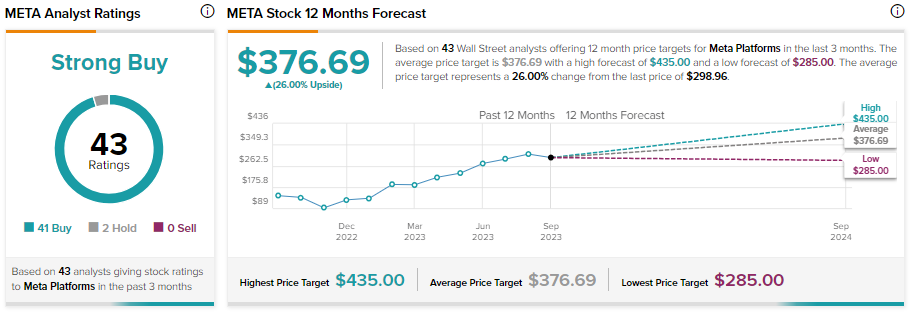

Shares of Meta Platform have gained over 148% year-to-date. Despite the significant increase in value, Wall Street is bullish about Meta stock. The company’s significant cost-cutting measures, improving online advertising environment, growing user engagement, and AI initiatives keep analysts optimistic about its prospects.

Out of 43 analysts covering Meta stock, 41 recommend a Buy. At the same time, two analysts have a Hold rating. Overall, Meta stock sports a Strong Buy consensus rating. Meanwhile, analysts’ average price target of $376.69 implies a further upside potential of 26% from current levels.