Meta Platforms (NASDAQ:META) integrates artificial intelligence (AI) tools into WhatsApp. The move is primarily aimed at enhancing business operations on the popular messaging app. This strategic initiative aligns with Meta’s broader strategy of driving the adoption of its AI products, bolstering its competitive positioning, and better monetizing its social media platforms over the long term.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new AI tools are designed to help businesses on WhatsApp provide better customer assistance and facilitate product discovery. Additionally, Meta is leveraging AI to assist businesses in creating advertisements on Facebook and Instagram. This will further solidify its position as a leader in the digital marketing space.

New Features Unveiled at Conversations Event

At its annual Conversations event in Sao Paulo, Brazil, Meta not only introduced AI tools but also launched Meta Verified. Additionally, they extended calling support for WhatsApp, enhancing its accessibility and functionality.

These new features are part of a comprehensive strategy to enhance the platform’s functionality and appeal to individual users and businesses.

Meta’s AI Strategy Under Scrutiny

Meta’s aggressive push to integrate AI into its products and lower costs has significantly boosted its share price. However, its AI strategy has come under scrutiny.

The company is allocating substantial resources to enhance its AI capabilities, but it is offering its latest AI models to the public at no cost, raising concerns about monetization. Further, the move could weigh on its earnings in the short term.

It’s worth noting that in April, Meta released Llama 3, its latest AI model, for free. This move has slowed the momentum in Meta stock, which is up about 40% year-to-date. Meta stock has been in the red since it launched the latest AI model on April 18.

Analysts Weigh In

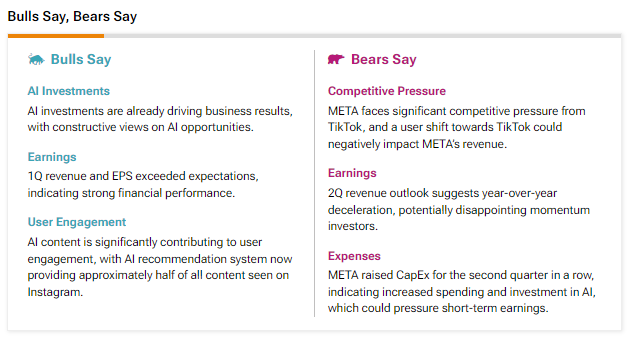

Analysts have mixed opinions on Meta’s current AI strategy. According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on Meta highlight that the company’s investments in AI are already yielding positive business results and foresee significant AI-driven growth opportunities in the future.

Conversely, analysts bearish on Meta stock caution that the substantial investments required to advance its AI capabilities might increase capital expenditures and exert pressure on earnings in the near term.

Is Meta a Buy, Hold, or Sell?

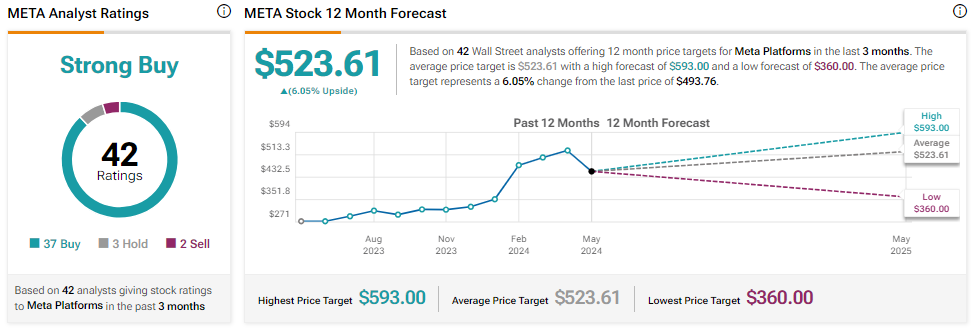

Despite concerns regarding its AI strategy, Wall Street is bullish about Meta’s prospects. Meta Platforms stock sports a Strong Buy consensus rating based on 37 Buys, three Holds, and two Sell recommendations.

Analysts’ average price target on META stock is $523.61, implying 6.05% upside potential from current levels.