Some of the Magnificent Seven members have been posting some rather non-magnificent returns over the past year. Undoubtedly, when it comes to the mega-cap tech titans, it’s been all about the AI boom and where each firm’s strategy stands to capitalize on this generational opportunity. In the running, we have AI innovators, such as Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG), that aren’t all too expensive compared to other tech stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

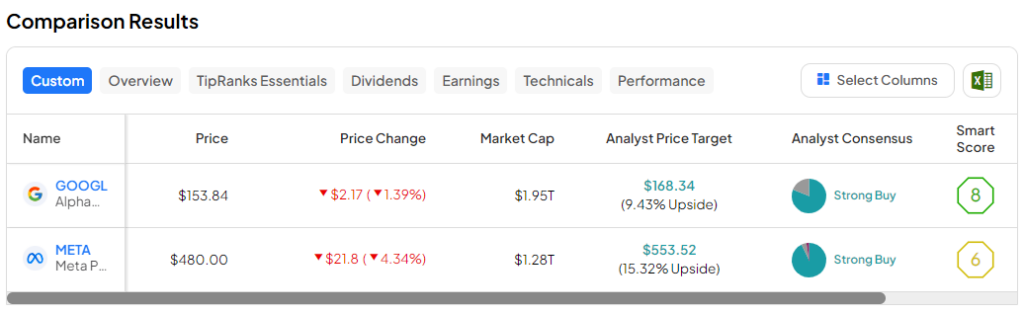

At current valuations, I view META and GOOGL stocks as reasonably priced AI stocks that the market may have yet to fully warm up to. That’s not to say that META and GOOGL stocks have been lukewarm of late; each name is up a great deal over the past year as investors flocked into the names with high AI hopes. At writing, shares of META and GOOGL are up an astounding 135% and 48% over the past year. Still, they have more upside potential.

Meta and Alphabet Shares Still Aren’t Looking All Too Expensive, Given Their AI Leads

Despite the impressive gains, their valuation multiples just don’t reflect the full disruptive potential of the AI innovations going on behind the scenes. Further, both innovators may be far closer to effectively monetizing such AI than some of the pricier tech stocks out there that may not be able to get as much AI bang for their invested buck.

Most notably, Adobe (NASDAQ:ADBE) stands out as an AI innovator that seems a tad too expensive at more than 45 times trailing price-to-earnings (P/E), even given the recent slew of new AI features it’s included across the suite of its existing products.

Comparatively, Meta and Alphabet shares go for 33.7 times trailing P/E and 26.9 times trailing P/E, respectively. Arguably, there’s a lot more to love about these magnificent two and their ability to drive earnings by applying weight to the AI gas pedal.

Both companies don’t just have impressive large language models (LLMs) that may breathe down the neck of OpenAI’s ChatGPT, but they also have impressive AI hardware in the pipeline that could lessen the dependence on third-party GPU makers as they look to maximize their AI acceleration firepower.

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to examine Meta and Alphabet, two Magnificent Seven members that I think could be in for the biggest strides as they continue giving all that they’ve got to advance their AI ambitions. And just for the record, I remain bullish on both companies for the long haul.

Meta Platforms (NASDAQ:META)

Meta stock has been a rocket ship in recent quarters, and though shares may seem expensive near record highs, traditional valuation metrics (like the P/E ratio) say otherwise. On a forward basis, META stock still looks like a value play—shares go for 24 times next year’s expected P/E—when you consider the magnitude of AI tailwinds it has behind its back right now.

With the company launching its Meta AI chatbot (powered by its latest Llama 3 model) this week, it will be interesting to see how the language model will fare against some pretty stacked competition. Indeed, many of us continue to gravitate to GPT-4 Turbo as our AI model of choice. However, a growing number of alternatives have landed in recent quarters, including Anthropic’s Claude, Mistal AI, Google Gemini, and countless others.

Arguably, the chatbot scene is starting to get a bit crowded, with many small startups on a seemingly even playing field with their much larger mega-cap rivals. In any case, the mega-cap tech titan seems to be hedging their AI bets with strategic investments in some of the more promising unicorn AI firms.

As powerful as Meta AI is, I believe it’s the integration within the social media family of apps that could be key to its mass adoption. With Meta AI coming to WhatsApp, which has around 2 billion monthly active users, the messaging app may finally prove its true worth to Meta.

With WhatsApp, Meta AI is already in the devices of most users. Even if Llama 3 isn’t the best chatbot at any given time, it’s still probably one of the most accessible to average users. Perhaps having Meta AI on the websites and apps we know and love (think Facebook, Instagram, and WhatsApp) will be an even bigger driver of usage than having a physical button to summon an AI assistant.

Either way, betting against Meta as it continues to drive Llama 3 forward, roll out Meta AI across its family of apps, and build the next generation of AI accelerators (the MTIA chip, used for both training and inference) would be unwise. These chips are likely to power future iterations of Meta’s powerful Llama.

What Is the Price Target for META Stock?

META stock is a Strong Buy, according to analysts, with 40 Buys, two Holds, and one Sell assigned in the past three months. The average META stock price target of $547.45 implies 14.9% upside potential.

Alphabet (NASDAQ:GOOGL)

Alphabet is another AI behemoth with newfound momentum that could take its stock to much higher levels. The company’s Gemini language model is incredibly popular among users, second only to ChatGPT, with 62% of those polled by Ignite Visibility noting that they’re using ChatGPT or Gemini to research products or services.

As Alphabet gives Gemini its all, the firm will also be looking to advance its AI acceleration capabilities with its tensor processing units (TPUs) that may very well phase out GPUs in the distant future. For now, TPUs will support GPUs as demand for more expensive AI computing surges.

Last May, the company already touted its TPU v5p chips as faster than Nvidia’s H100 GPU. As the next generation of AI accelerators comes to be, I’d not be surprised if the coming v6 version also stands out as a top performer. The only question is whether Alphabet can make enough TPUs.

The company’s latest on-device Tensor G3 chip, which was released last October, is also pretty intriguing, as it could help Alphabet punch its ticket to the “edge AI” race. Undoubtedly, only time will tell where consumers desire to run their AI applications (cloud or on-device). Regardless, Alphabet is poised to win either way.

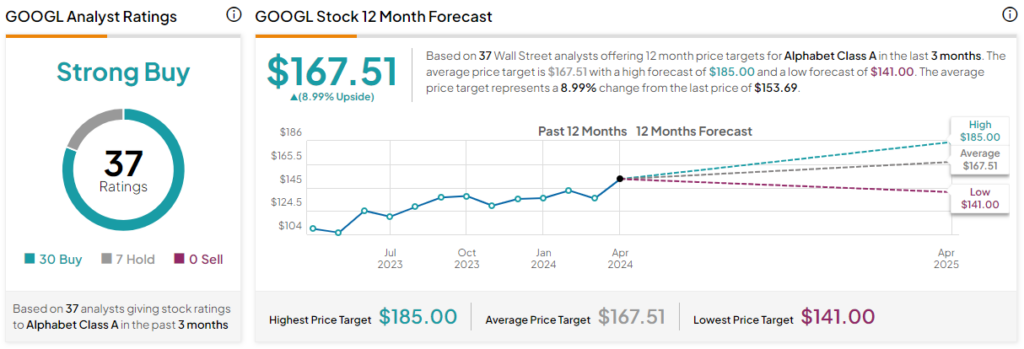

What Is the Price Target for GOOGL Stock?

GOOGL stock is a Strong Buy, according to analysts, with 30 Buys and seven Holds assigned in the past three months. The average GOOGL stock price target of $167.51 implies 9% upside potential.

The Bottom Line

Meta and Alphabet are sprinting in the AI race with impressive AI models and powerful new AI hardware under development. Though I’m unsure which company will be in the lead a few years from now, I do like the chances of Meta and Alphabet as they do their best to close the gap with the firms that are currently in the lead.

Given their AI prowess, I think a strong case can be made for much higher multiples in each Magnificent Seven member. Wall Street certainly seems to think considerable upside is ahead for each firm.