Shares of Meta Platforms (NASDAQ:META) gained in today’s trading after the tech company announced the integration of Meta AI across its family of apps: Facebook, Instagram, WhatsApp, and Messenger. It’s also available through its own website, Meta.ai.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, the Llama 3 models that power the firm’s AI will soon be available on cloud platforms AWS, Google Cloud, and Microsoft Azure. The company also improved the AI’s image capabilities by speeding up the process of real-time creation.

Meta AI has essentially positioned itself as a competitor to Microsoft-backed ChatGPT (NASDAQ:MSFT). Looking forward, Meta plans to introduce new capabilities such as longer context windows and various model sizes.

Is Meta Stock a Buy?

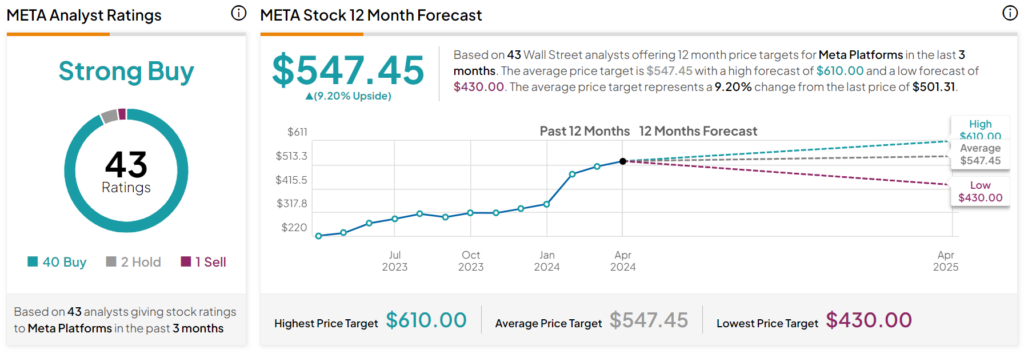

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 40 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 129% rally in its share price over the past year, the average META price target of $547.45 per share implies 9.2% upside potential.