Last week’s earnings call didn’t deliver what Merck & Co. (MRK) investors were hoping for. While the company posted what initially appeared to be a solid earnings report, weaknesses in several business segments clouded the overall performance. As a result, MRK stock rose rather quickly on the day of its earnings news (October 30) but has since lost momentum and given up more than 50% of its gains. However, for eagle-eyed options traders willing to take a quantitative approach, the recent pullback may offer a compelling bullish opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s not the results that pharmaceutical giant Merck and Co. (MRK) was hoping for. While the company delivered what on paper appeared to be a strong earnings print, key hiccups in certain business units detracted from the overall picture. As such, MRK stock suffered a loss of momentum in the charts. Still, from a quantitative perspective, the red ink arguably presents a contrarian opportunity.

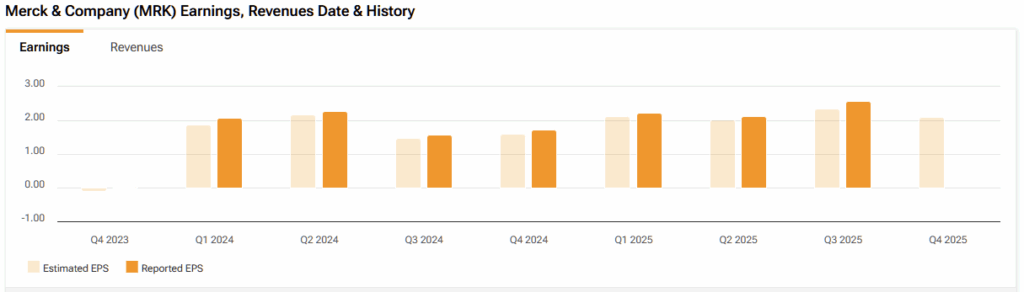

At first glance, circumstances don’t seem auspicious. Yes, Merck delivered earnings per share of $2.58 in the third quarter, exceeding Wall Street analysts’ consensus target of $2.36. On the top line, the pharma giant generated $17.28 billion, up solidly against the estimated $16.98 billion. However, Merck’s human papillomavirus (HPV) vaccine GARDASIL suffered a 25% decrease, primarily due to lower sales in Japan and challenges in the Chinese market.

Furthermore, the pharma giant experienced a 3% decline in companion animal sales due to decreased veterinary visits and competition in parasiticides. Finally, Merck’s launch of ENFLONSIA, a monoclonal antibody medication used for the prevention of respiratory syncytial virus (RSV), experienced a slight delay, which impacted initial sales. With the combined headwinds, MRK stock declined by roughly 6% in the trailing month. For the year, the security is down about 13%.

For many investors, the steep decline in a long-standing industry leader may be viewed as alarming. However, the quant picture suggests there’s a mismatch between expected and likely outcomes. Subsequently, astute traders can potentially exploit this informational gap.

Understanding the Criticality of the Quant Mindset

While the vast intricacies of the quant mindset are beyond the scope of any single article, it’s essential to understand its foundational principles. Essentially, quant analysts use empirical data to justify their decision-tree logic. To accomplish this task, the analyst must determine the baseline probability of a particular event and the conditional probability of the specific signal or situation at hand.

Like in team sports, a manager can elect to substitute players in the game. However, once a substitution is made, that same player cannot re-enter the same game. Therefore, the manager must consider two probabilistic outcomes: the benefit of maintaining the current roster (baseline) versus the benefit of making the substitution (conditional).

Obviously, the manager needs to have an empirical calculation for these two outcomes. If the benefits of making the substitution outweigh the collective costs of the decision, along with the benefits of making no change, then the green light is given. If not, then it makes no sense to alter the roster. The problem, though, is that without knowing these odds, the manager would be making decisions purely on emotion.

My issue with the traditional methodologies of fundamental and technical analysis, as they are commonly practiced, is that they only offer presumed outcomes without providing counterfactual evidence to support them. In quantitative analysis, the user of the methodology quantifies the idea being proposed. Put another way, there’s a rational reason behind the trade, other than seeing strange shapes in the (Ichimoku) clouds.

Using Real Data Science to Formulate a Trade for MRK Stock

To be sure, having a firm grasp of the theory of quant analysis is only part of the process; the other component is to apply relatively obfuscated methods to identify potential pricing inefficiencies or the aforementioned informational arbitrage. From there, we can pounce on ideas that are essentially mispriced in our favor.

In the case of MRK stock, the forward 10-week median returns would be expected to form a distributional curve under baseline or homeostatic conditions, with outcomes ranging from roughly $83 to $84.50, assuming Tuesday’s close of $83.86 as the anchor price. Furthermore, price clustering is expected to occur predominantly at $83.90, indicating a slight upward bias.

However, we know through GARCH (Generalized Autoregressive Conditional Heteroskedasticity) studies that volatility diffuses in a clustered, non-linear manner. By logical inference, we may determine that different market stimuli yield different market behaviors. We’re really talking about Newtonian mechanics, but adapted for the financial markets.

Now, the arbitrage argument for MRK stock centers on the reality that the security is not structured in a homeostatic state but rather in a heavily distributive 3-7-D sequence: three up weeks, seven down weeks, with an overall downward slope. Under this condition, MRK’s forward 10-week returns would be expected to range between $83 and $88. Most importantly, price clustering would be expected to occur around $85.90.

There are two key takeaways here. First, under 3-7-D conditions, there is no penalty for expanding the risk tail. Instead, the reward tail jumps out to $88 (instead of $84.50), making this quant signal a statistical win-win. Second, traders can potentially take advantage of the 2.38% delta in price density dynamics — a variance that no one in finance is talking about.

Drilling into Specific Merck Trading Ideas

We can’t delve too deeply into the quantitative arena without providing some actionable ideas. There are two options-focused trades that stood out, depending on your risk tolerance.

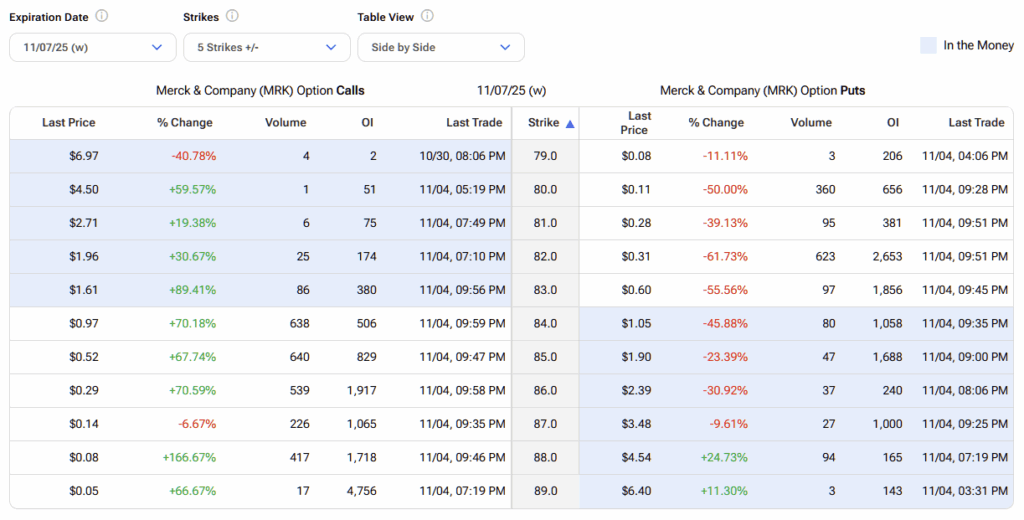

First, for those seeking short-term returns, the 84/86 bull call spread expiring November 21 is enticing. This transaction involves buying the $84 call and simultaneously selling the $86 call, for a net debit paid of $98 (the maximum possible loss on the trade). If MRK stock rises through the second-leg strike of $86 at expiration, the maximum profit is $102, or a payout of 104%. Breakeven lands at $84.98.

Second, for those seeking a bit more time, the 80/90 bull spread expiring December 19 could be of interest. This trade requires MRK stock to rise through the $90 strike at expiration to trigger the maximum payout of 100%. That might be a bit of a stretch in terms of distributional outcomes. However, the breakeven for this trade is $84.99. As stated earlier, with the clustering or density dynamics, the breakeven point is a realistic target.

Is Merck a Buy, Sell, or Hold?

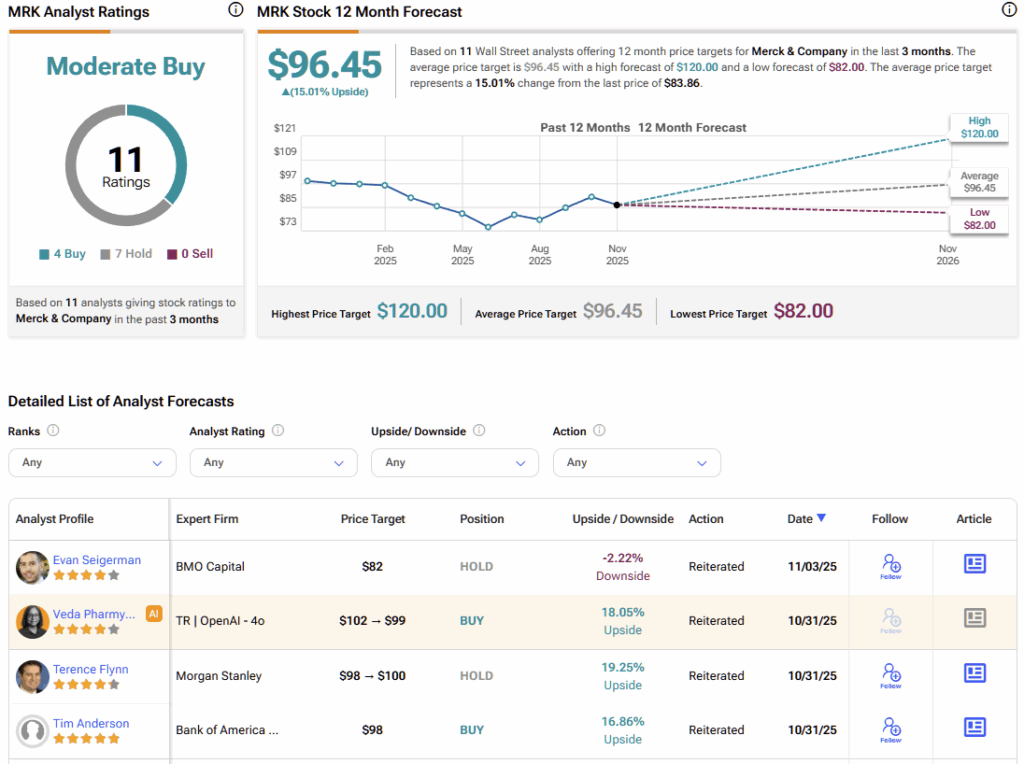

Turning to Wall Street, MRK stock carries a Moderate Buy consensus rating based on four Buys, seven Holds, and zero Sell ratings over the past three months. The average MRK stock price target is $96.45, implying 15% upside potential.

Merck’s Pullback Hides a Quant-Driven Arbitrage Opportunity

Although Merck has lost momentum after a lukewarm market reaction to its latest earnings report, the recent pullback may be masking a contrarian arbitrage opportunity. Through quantitative analysis, traders can identify discrepancies between market expectations and statistically grounded outcomes — and potentially profit from those mispricings.