American multinational pharmaceutical company Merck (NYSE:MRK) has urged the UK government to support the sector as it sets out to open its £1 billion research center in London next week. Although Merck appreciates the country’s foray into science and its massive talent pool, it did say that the government needs to become more welcoming towards pharma companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per a Financial Times report, Merck is set to open its ambitious research center at King’s Cross in London, which is known for the abundance of the city’s life science institutes. The area is surrounded by medical universities, which will help Merck work closely with academics and students in the research field. Merck aims to find new treatments and medicines in the field of neurology.

Challenges for Pharma Companies in the UK

Dean Li, President of the company’s research laboratories, urged Chancellor Jeremy Hunt and the health department to improve the country’s drug pricing mechanism. Moreover, Li stated that London needs to reduce the complications in running clinical trials in the NHS (National Health Service). Plus, he noted that the tax rate in the UK is very high, especially the increasing clawback taxes that the NHS is proposing to be paid on the drugs.

Under the voluntary agreement between pharma companies and the NHS, a 2% cap has been placed on the growth in branded prescription drug sales to the NHS. Once the bill exceeds the cap, pharma companies are required to pay back the additional revenue.

These hurdles stand to direct pharma companies to other European states that have more lax tax standards and are more welcoming. Li surely hopes that the UK officials will heed his requests and that Merck can proudly vouch in the future that it made a good investment decision. Earlier this year, drug companies AbbVie (NYSE:ABBV) and Eli Lilly (NYSE:LLY) withdrew their pricing agreement with the UK government owing to the pricey clawback payments.

Is Merck a Good Stock to Buy?

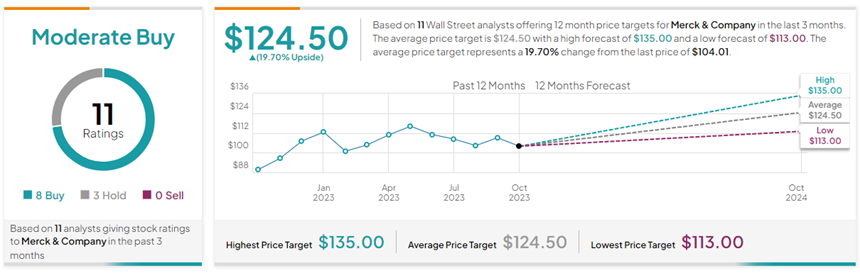

Recently, Morgan Stanley analyst Terrance Flynn cut the price target on MRK to $115 (10.6% upside) from $116 while retaining a Hold rating.

Overall, Wall Street remains cautiously optimistic about Merck stock. Based on eight Buys and three Hold ratings, Merck has a Moderate Buy consensus rating on TipRanks. Also, the average Merck price target of $124.50 implies 19.7% upside potential from current levels. Meanwhile, MRK stock has lost 4.5% so far this year.