Shares of Latin American e-commerce giant MercadoLibre (NASDAQ:MELI) took a tumble following a Bank of America alert about new cross-border tax rules. The firm switched its rating on MercadoLibre from Buy to Neutral, slashing the price target from $1,680 to $1,350. According to the BofA team led by Robert Ford, these tax changes, which shield direct-to-consumer e-commerce buys of up to $50 from a 60% import tariff, could potentially disrupt MercadoLibre’s operations by enticing more competition.

MercadoLibre’s significant Brazilian merchant base, dealing mainly in sectors like fashion and consumer electronics, faces the threat of tax-free cross-border rivals. While some optimists predict policymakers might try to rectify this imbalance, the bank cautions that such steps could potentially backfire among Brazilian voters. BofA analysts also believe that while MercadoLibre might try to capitalize on its own cross-border opportunities, this transformation could be time-consuming and could fuel competitive worries from pure cross-border platforms and other related entities.

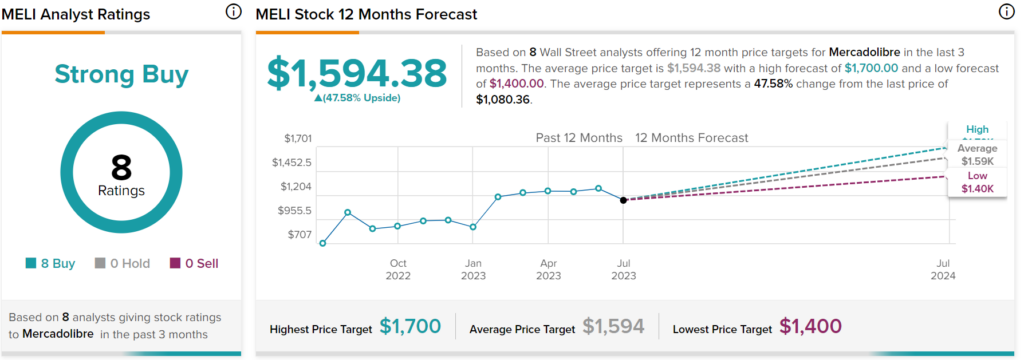

What is the Target Price for MELI Stock?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MELI stock based on eight Buys assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $1594.38 per share implies 47.58% upside potential.