Medtronic (NYSE:MDT) shares jumped nearly 2% in the early session today after the medical device major delivered a robust second-quarter performance. Revenue increased by 5.4% year-over-year to $8 billion, exceeding estimates by $70 million. EPS of $1.25 also outpaced expectations by $0.07.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The quarter was marked by strength across Medtronic’s businesses and geographies. Revenue in the Cardiovascular portfolio ticked higher by 4% thanks to strength in cardiac pacing therapies, aortic and cardiac surgery, and the Onyx Frontier drug-eluting stent. Moreover, the company bagged approvals for the Aurora EV-ICD system and Symplicity Spyral RDN system in the U.S.

In addition, revenue in the Neuroscience portfolio increased by 4.7%, while the Medical Surgical portfolio experienced a 7% increase. Revenue in the Diabetes segment surged by 9.7% due to gains from the MiniMed 780G system and Guardian 4 sensor.

Buoyed by this performance, Medtronic raised its financial outlook for Fiscal Year 2024. Revenue for the year is now expected to increase by 4.75%, compared to the earlier expectation of a 4.5% growth. In addition, EPS for the year is anticipated to land between $5.13 and $5.19, up from the previous estimated range of $5.08 to $5.16.

What is the Forecast for MDT Stock?

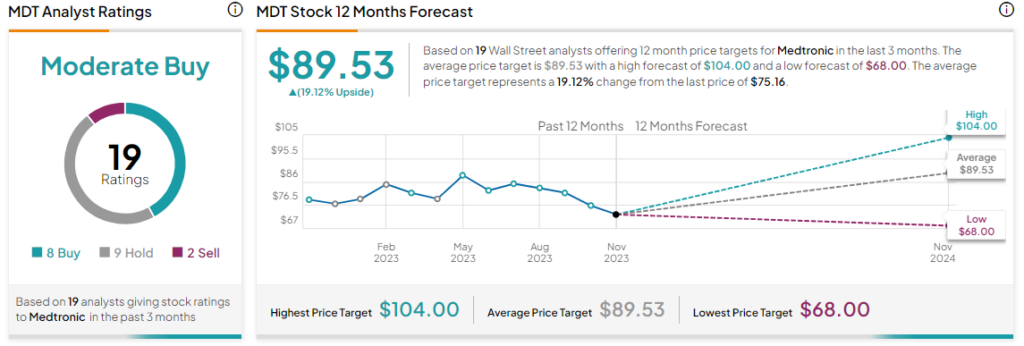

Overall, the Street has a Moderate Buy consensus rating on Medtronic. After a nearly 16% slide in the company’s shares over the past six months, the average MDT price target of $89.53 implies a 19.1% potential upside.

Read full Disclosure