It’s been a great day for medical technology firm Medtronic (NYSE:MDT). It went up a notch with one analyst, thanks to several key points, which was good news for investors as well, who sent shares up over 4% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The best news came from Wells Fargo analyst Larry Biegelsen, who upgraded to Buy with a price target of $100 per share. That’s up from its original value of $77. Biegelsen pointed out several key factors in his ratings and price target hikes, starting with the stock’s currently attractive valuation, as well as the upcoming pipeline of new product releases and overall improvements in medical technology. However, he also pointed out a set of potential risks, starting with any delays in product launches and any weakness in the markets for end users that might restrict purchases.

Indeed, Medtronic’s pipeline is pretty packed with awesome hardware. Start with the recently FDA-approved MiniMed 780G and go on from there. The new MiniMed system not only recently had its use of the SmartGuard system improved but can now accommodate the Guardian 4 sensor system. With the Guardian 4, the MiniMed can provide proper insulin levels for patients at baseline and at mealtimes. That means less fluctuation, better regulation, and better outcomes for patients. The MiniMed 780G has already been available in Europe for the last three years, so seeing it in the United States will prove a relief to some.

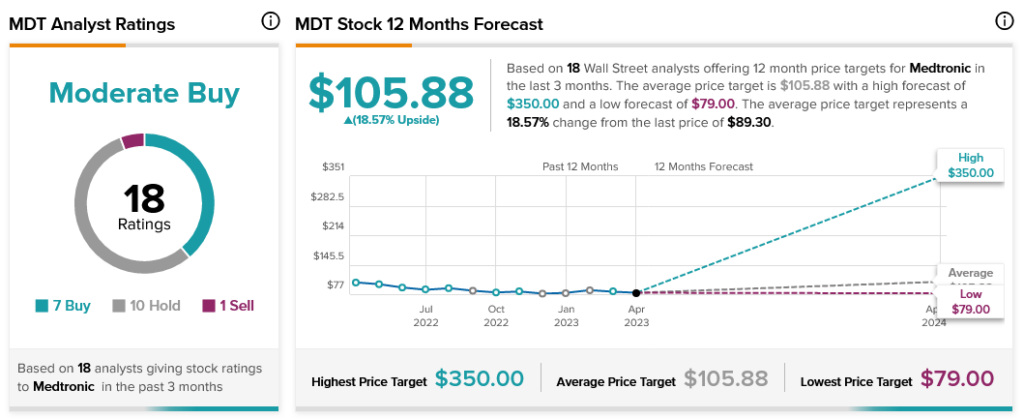

Analysts are a bit less sure overall, though. Analyst consensus calls Medtronic stock a Moderate Buy with seven Buy ratings, 10 Holds, and one sell. Further, with an average price target of $105.88, it boasts 18.57% upside potential.