Before market open today, MDA Ltd. (TSE:MDA), a developer and manufacturer of technology and services for the global space industry, reported strong Q4-2022 and Fiscal 2022 earnings results. The stock finished 2.15% higher today, as it beat both revenue and earnings per share (EPS) estimates while providing guidance for 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q4-2022 Results

MDA’s Q4 revenues grew 61% year-over-year, reaching C$186.1 million. This beat the consensus estimate by C$7.25 million. Further, earnings per share (EPS) of C$0.06 were ahead of the C$0.033 consensus. For reference, last year’s EPS came in at C$0.03.

Moreover, MDA’s adjusted EBITDA reached C$39.9 million, a 49% increase, for an adjusted EBITDA margin of 21.4%. Additionally, operating cash flow increased by 16.8% to C$40.3 million, and the company’s backlog grew by 59% to C$1.4 billion.

Full-Year Results

For the full year, revenues came in at C$641.2 million, a 34% increase, as MDA saw strength in its Satellite Systems and Robotics & Space Operations businesses and continued to work through its backlog. Also, adjusted EBITDA reached C$157.9 million — a 15% year-over-year increase (a 24.6% margin).

However, operating cash flow fell 20.9% to C$57 million, mostly due to a “$12.7 million pre-payment made in 2022 for inventory to be received in 2023 and beyond” to bolster MDA’s strategic ambitions.

Q1-2023 and FY2023 Guidance

MDA’s Q1-2023 revenue is expected to grow by 50% year-over-year. However, for Fiscal 2023, MDA expects revenue of C$750 million to C$800 million, which suggests about 20% growth at the midpoint. In addition, adjusted EBITDA is forecast to be between C$145 million to C$155 million, for an adjusted EBITDA margin range of 19% to 20%. MDA also plans to keep investing in growth, forecasting capital expenditures to range from C$220 million to C$240 million.

Is MDA a Buy, According to Analysts?

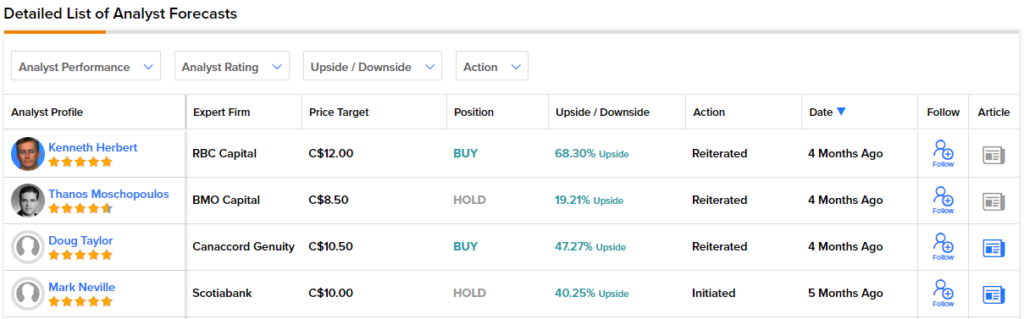

While MDA doesn’t have any analyst ratings from the past three months, it does have some Buy ratings from four to five months ago given by top-rated analysts. For instance, four months ago, Kenneth Herbert, ranked #87 out of 32,113 experts on TipRanks, gave MDA a C$12 price target (68% upside potential).