McKesson (NYSE: MCK) shares gained almost 5% during the extended trading session on February 2, after the company delivered robust fiscal third-quarter results topping estimates, and raised its fiscal FY2022 guidance well above the analysts’ expectations.

The quarterly beat was driven by a strong contribution from the U.S. government’s COVID-19 vaccine distribution, robust performance across all segments, kitting and storage programs as well as a lower share count.

McKesson is a U.S.-based healthcare company involved in pharmaceutical distribution and provides health information technology, medical supplies, and care management tools.

Fiscal Q3 Beat

Adjusted earnings of $6.15 per share grew 34% year-over-year and significantly beat analysts’ expectations of $5.42 per share. The company reported earnings of $4.60 per share for the prior-year period.

Further, revenues jumped 10% year-over-year to $68.6 billion and exceeded consensus estimates of $66.42 billion.

The increase in revenues reflects growth in the U.S. Pharmaceutical segment, driven by higher volumes from retail national account customers and strong market growth, which offset branded-to-generic conversions.

Raised FY2022 EPS Guidance

Based on robust Q3 results as well as higher contributions from the U.S. government’s COVID-19 vaccine distribution programs, management raised the financial guidance for FY2022.

The company now forecasts adjusted earnings in the range of $23.55 to $23.95 per share, while the consensus estimate is pegged at $22.78 per share.

CEO Comments

Looking ahead, McKesson CEO, Brian Tyler, commented, “As a result of our underlying business performance across all segments, and our ongoing support of the COVID-19 response efforts, we are raising our previous guidance range for fiscal 2022 Adjusted Earnings per Diluted Share to $23.55 to $23.95.”

Wall Street’s Take

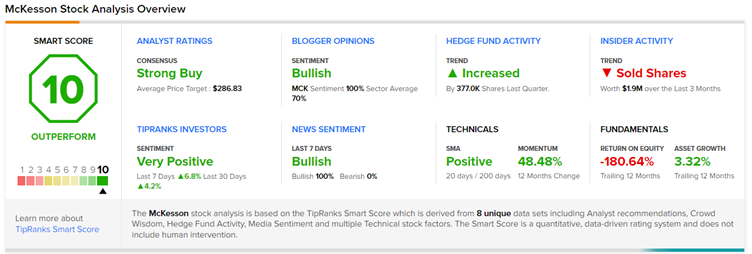

Overall, the stock has a Strong Buy consensus rating based on 11 Buys and 1 Hold. At the time of writing, the average McKesson stock forecast was $286.83, which implies 10.98% upside potential to current levels.

TipRanks’ Smart Score

MCK scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

General Motors Posts Mixed Q4 Results

PulteGroup Delivers Upbeat Q4 Results

Stanley Black & Decker Beats Q4 Earnings But Misses Revenues Estimates