Fast-food chain McDonald’s (MCD) is scheduled to announce its results for the third quarter of 2025 before the market opens on Wednesday, November 5. The company has been under pressure due to subdued traffic amid high inflation and intense competition. McDonald’s has been trying to improve its performance through value deals, menu innovation, and marketing initiatives. Wall Street expects McDonald’s to report Q3 earnings per share (EPS) of $3.33, up 3.1% from the prior-year quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenue is expected to rise 3% to $7.08 billion. Investors will look forward to management’s commentary on the business backdrop, margins, and traffic trends.

Analysts’ Views Ahead of McDonald’s Q3 Earnings

Recently, Barclays analyst Jeff Bernstein increased his price target for McDonald’s stock to $362 from $360 and reiterated a Buy rating as part of a Q3 preview for the restaurant group. The 4-star analyst noted that comparable sales were “choppy” in the quarter.

Despite a rise in value offers, Bernstein noted that comparable sales slowed in September, with the fast-casual category hit hardest. Bernstein also highlighted the rise in food inflation on certain items, with some restaurants increasing prices despite ongoing weakness in traffic.

Meanwhile, KeyBanc analyst Eric Gonzalez reiterated a Buy rating on MCD stock with a price target of $335, saying “McDonald’s expectations have moderated.” Gonzalez continues to prefer McDonald’s and Restaurant Brands International (QSR) as both companies are outperforming rivals in a tough backdrop. The analyst noted that buy-side expectations for McDonald’s U.S. comparable sales have eased to the 1.5% to 2% range, with improvement expected in Q4 results.

AI Analyst Is Bullish on MCD Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to McDonald’s stock with a price target of $335, indicating 13% upside potential. The AI analyst’s rating is based on solid financial performance and international growth, partially offset by high leverage and challenges in the U.S. market.

Additionally, the AI Analyst cautioned that technical indicators suggest a neutral trend, while valuation metrics indicate moderate attractiveness.

Here’s What Options Traders Anticipate from McDonald’s Q3 Earnings

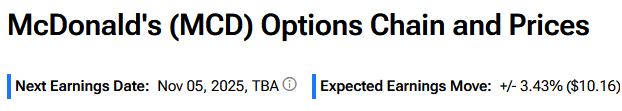

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 3.43% move in either direction in MCD stock in reaction to Q3 2025 results.

Is MCD Stock a Buy, Hold, or Sell?

Wall Street has a Moderate Buy consensus rating on McDonald’s stock based on 13 Buys and 13 Hold recommendations. The average MCD stock price target of $326.14 indicates 10% upside potential.