The choice of where to go to eat is a troubling one for individuals, couples, and families alike. But for Truist Financial analysts, two restaurant stocks presented themselves as excellent buys. You might be surprised at which two got the nod, though: McDonald’s (NYSE:MCD) and Shake Shack (NYSE:SHAK) proved ahead of the game. The results were somewhat unexpected: Shake Shack gained slightly in Tuesday’s trading, while McDonald’s fell fractionally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Truist analyst Jake Bartlett offered the rundown, noting that Truist Card Data offered much of the information that went into the decision. The current adjusted estimate for the second quarter numbers out of McDonald’s stands at $13.9 billion, about 3.5% ahead of consensus estimates. McDonald’s marketing has definitely helped here as well, with the Grimace Shake promotion leading the pack. Though there have been some troubles along the way, particularly with McDonald’s recent troubles over widespread sexual harassment allegations.

Shake Shack, meanwhile, is enjoying some advancing earnings as well, with current figures about 1.8% above estimates, coming in at $269 million. Same-store sales growth is also expected in the low-single-digits range, with Truist projections coming in at 5.5%, well ahead of Shake Shack’s own guidance.

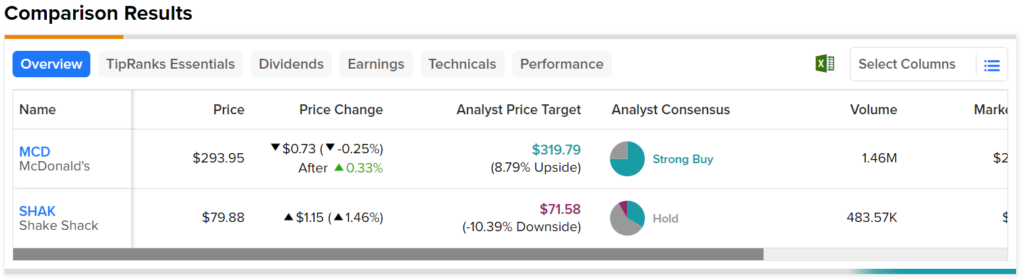

While Shake Shack fared better in trading than McDonald’s today, the longer-term story is much different. McDonald’s is rated a Strong Buy by analyst consensus and has a 8.79% upside potential on an average price target of $319.79. Shake Shack, meanwhile, is considered a Hold and comes with a 10.39% downside risk on an average price target of $71.58.