Maxeon Solar (NASDAQ:MAXN) shares are down nearly 24.6% today after the solar panels maker announced second-quarter numbers alongside a disappointing financial outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue jumped 46.3% year-over-year to $348.4 million but fell short of expectations by $24.2 million. However, net loss per share at $0.03 came in narrower than estimates by $0.04. The company recently completed its 1.8 GW capacity expansion in Mexicali and has zeroed in on Albuquerque for its planned solar cell and module facility.

Amid a challenging macro environment, the demand scenario in the worldwide distributed generation (DG) market has become weaker. Maxeon expects these conditions to continue at least through the third quarter. In Q2, Maxeon’s shipments stood at 807 MW compared to 521 MW in the prior year.

In the third quarter, Maxeon expects shipments to hover between 700 MW and 740 MW, with revenue anticipated between $280 million to $320 million. Adjusted EBITDA for the quarter is seen landing between $2 million and $12 million.

Moreover, owing to a near-term softness in residential demand and worsening macro conditions, the company now expects full-year 2023 revenue to land between $1,250 million and $1,350 million. Adjusted EBITDA for the year is anticipated between $80 million and $100 million.

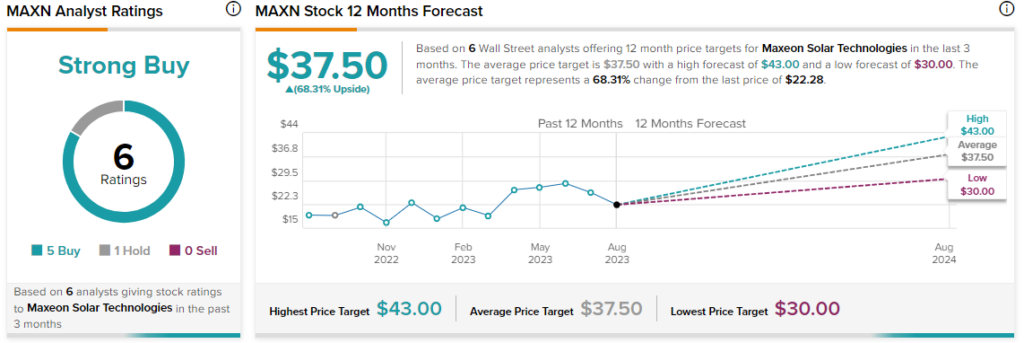

Overall, the Street has a $37.50 consensus price target on Maxeon alongside a Strong Buy consensus rating. This points to a substantial 68.3% potential upside in the stock.

Read full Disclosure