They say firing employees is a great way to goose the stock price. It doesn’t always work, but when it does, it often works big. Just ask Matterport (NASDAQ:MTTR), the software maker who laid off around one in three of its employees in a recent move. Its share price jumped over 9% in Tuesday’s trading, which demonstrates that the tactic still delivers results. All told, around 170 employees (30% of the workforce) at Matterport will lose their jobs as Matterport seeks to cut back on its spending and improve its path to profitability.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In fact—according to word from RJ Pittman, Matterport’s CEO—the move will ultimately make Matterport profitable a full year ahead of schedule. Further, the move will “…sharpen our focus, speed up execution, and accelerate our path to operational cash flow profitability….”

While this likely won’t come as much comfort to the 170 employees about to lose their jobs, Matterport shareholders will likely feel much better about it. This is particularly the case as Matterport is set to announce its second-quarter results in about three weeks. And with SEC filings revealing that Matterport will spend between $4 million and $5 million to make these cuts happen, it’s easy to wonder how this will impact its second-quarter earnings.

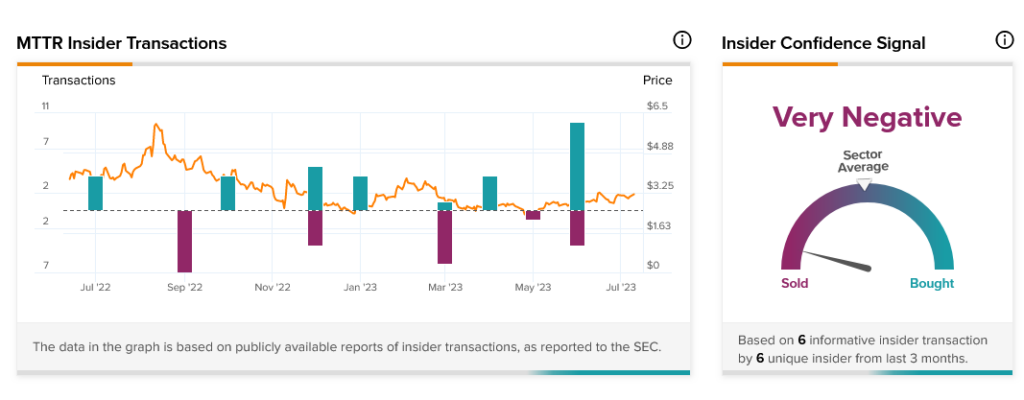

Either way, insiders aren’t particularly happy with Matterport. Insider trading at Matterport reveals that insiders have sold $1.8 million worth of shares in the last three months alone. Worse, insider confidence is classified as “Very Negative,” which will likely have some wonder if this is the last round of job-cutting at Matterport.