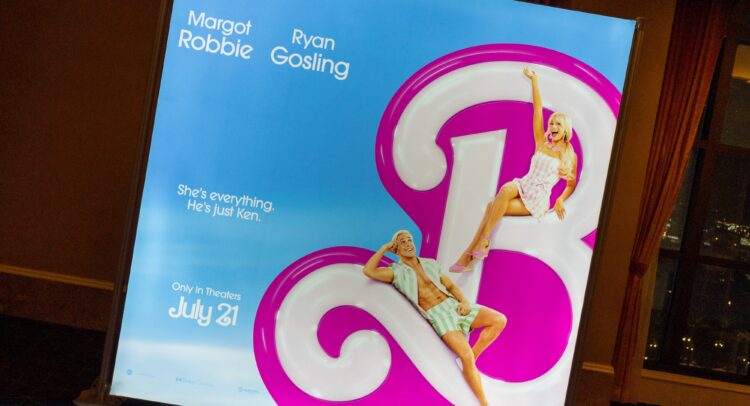

Toy maker Mattel (NASDAQ:MAT) is blossoming with the successful weekend opening of its first-ever live-action movie Barbie. MAT stock is up 2% at writing, and the stock has gained over 28% in the past three months, thanks to the momentum built for the movie since its trailer release.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per stats from Rotten Tomatoes, Barbie grossed $155 million in its opening weekend in the U.S. Plus, the movie earned another $182 million internationally, leading to the highest box-office start of the year so far. Barbie also now holds the record for the biggest opening for a woman-directed movie.

Barbie did strongly outpace its “Barbenheimer” counterpart, Oppenheimer’s theatrical release the same weekend. Oppenheimer grossed $80.5 million in the U.S. and $174 million globally. While the whole Barbenheimer effect did do well to promote the attention of both movies, Barbie did wonders at the box office, and its huge triumph is seen as laying the pathway for MAT’s success.

Here’s What This Goldman Sachs Analyst Says

Last week, before Barbie’s release, Goldman Sachs analyst Stephen Laszczyk raised the price target on MAT to $24 (13.3% upside) from $21. This price target raise also comes ahead of MAT’s earnings release on July 26. Particularly, Laszczyk noted three points from Barbie’s release that will help Mattel to improve performance, going forward.

First, the analyst believes that Mattel will benefit from the licensing of the Barbie logo and merchandise with retailers. Licensing the Barbie brand has helped to increase consumer awareness of the brand and has created hype for the movie. The analyst believes that Mattel is collecting licensing fees from retailers, which typically range between 10% to 20% of the product’s sales.

Secondly, the movie has led to indirect marketing of Barbie toys and related Mattel products. The company can thus reduce its expenses on marketing for the toys in the medium term.

Lastly, Laszczyk believes that the movie will help Barbie’s seasonal sales cycle as the “halo effect” will continue to trigger sales in the medium to longer term. As the movie is PG-13 rated, adult audiences are likely to gift the doll to kids on upcoming occasions, the analyst added.

What is the Price Target for Mattel Stock?

On TipRanks, the average Mattel price target of $23.67 implies 9.9% upside potential from current levels. MAT stock commands a Strong Buy consensus rating based on three unanimous Buys. Year-to-date, MAT stock is up 20.4%.