Mark Zuckerberg‘s charity sold shares of social media giant Meta Platforms (NASDAQ:META) amid legal turmoil in Europe. The AMI newspaper publishing association, a group representing 83 Spanish media outlets, has filed a €550 million ($598 million) lawsuit against Meta Platforms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The lawsuit alleges unfair competition in advertising. The group, including Spanish media groups Prisa and Vocento, have claimed that Meta’s use of personal data from Facebook, Instagram, and Whatsapp users gives it an unfair advantage in personalized ads. Moreover, the lawsuit alleges that since these targeted ads use the user’s personal information without their consent, it violates data protection rules.

Meta’s Zuckerberg Sells First META Shares in Two Years

Meanwhile, Mark Zuckerberg’s trust, the Chan Zuckerberg Initiative, and his other entities that give to charity and political parties sold about 682,000 META shares worth almost $185 million in November, according to the company’s filings. This is the first time that these entities have sold shares since November 2021.

Zuckerberg currently owns 13% of Meta, which makes up a lion’s share of his $117.7 billion fortune, according to the Bloomberg Billionaires Index.

In addition, when looking at TipRanks’ Insider Trading tool, corporate insiders have sold $12.8 million worth of shares over the past three months. As a result, the insider confidence signal is currently very negative for META stock.

Is Meta a Buy, Sell, or Hold?

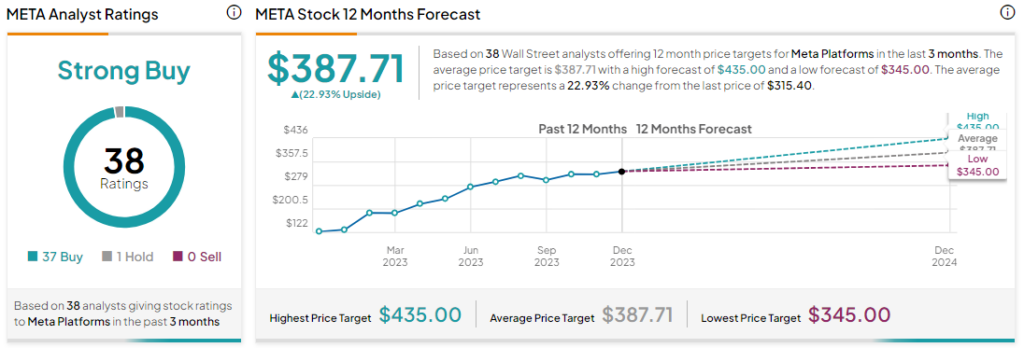

Analysts remain bullish about META, with a Strong Buy consensus rating based on 37 Buys and one Hold. Year-to-date, META has surged by more than 100%, and the average META price target of $387.71 implies an upside potential of 22.9% at current levels.