Gambling on sports is nothing new. Even in states where it was illegal—and that’s been the case for quite some time—the informal office pool was a long-standing institution. Yet, with more states bowing to the inevitable (not to mention getting a piece through taxes), more and more sports gamblers are stepping up. March Madness, for example, is expected to bring in over 68 million Americans.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

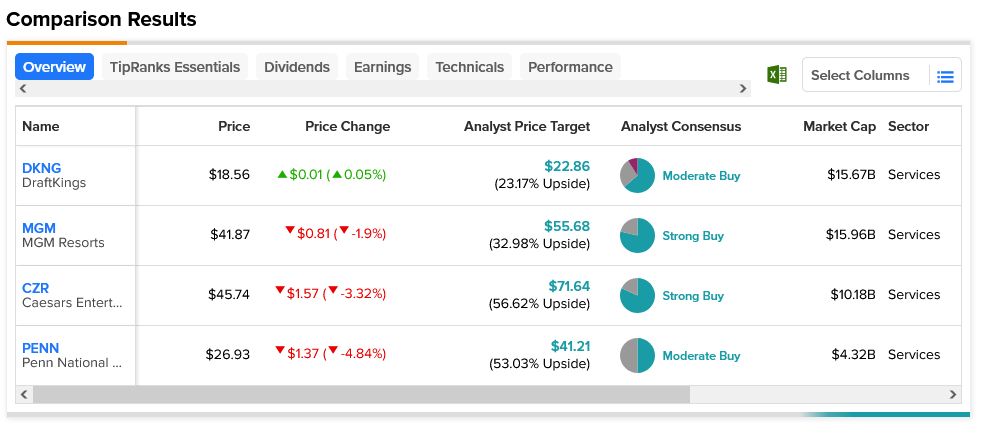

Incoming bettors will have no shortage of potential platforms on which to bet. DraftKings (NASDAQ:DKNG), MGM Resorts (NYSE:MGM), Caesars Entertainment (NASDAQ:CZR), and Penn National Gaming (NASDAQ:PENN) are just some of the companies that gamers can turn to. Reports suggest that gamblers won’t be chintzy, either, distressing macroeconomic conditions aside. Americans alone mean to shell out a combined $15.5 billion on the tournament, and that’s up just over five-fold from the 2022 total of $3.1 billion.

Of course, that whole figure won’t be going directly to newly-available options. Around 21 million are planning to simply make bets with friends, backed up by little more than a handshake. Meanwhile, 56.3 million are looking forward to that formerly-illegal office pool or similar bracket contest. Still, a substantial 31 million will be turning to platforms, bookies, or retail sportsbooks to place their bets. Such a move will likely give casino stocks a bit of an edge, at least for a while, particularly when earnings season comes around and the final counts are in.

As for the four platforms referenced today, they’re in a range of conditions. Two are considered Strong Buys by analyst consensus: MGM Resorts and Caesars Entertainment. DraftKings and Penn National are merely Moderate Buys. DraftKings has the lowest upside potential of the four; its $22.86 price target gives it 23.17% upside potential. Meanwhile, Caesars’ $71.64 average price target gives it 56.62% upside potential.